2023 could be another volatile year, with all attention focused on the interest rate hikes by the Federal Reserve.

Should you embrace volatility?

How?

Execute shorter-term swing trades.

“What is swing trading?” you ask.

Swing trading is shorter-term in nature, lasting for just a couple of days to a couple of weeks.

The aim in swing trading is to capture the explosive up/down move in a bull/bear market respectively.

Due to high volatility, it’s more ideal to adopt swing trading strategies than position trading strategies. You’ll want to seize opportunities rather than be on a rollercoaster ride.

Shall we revisit our analysis on shorting the shares of Tesla in Dec 2022?

A mini pullback occurred and its share price quickly tumbled by more than 12% thereafter. You would’ve pocketed that amount if you’d taken the trade.

And this brings me to this week’s swing trading opportunity: The Interpublic Group.

Let’s analyze this stock and the swing trading opportunity it brings.

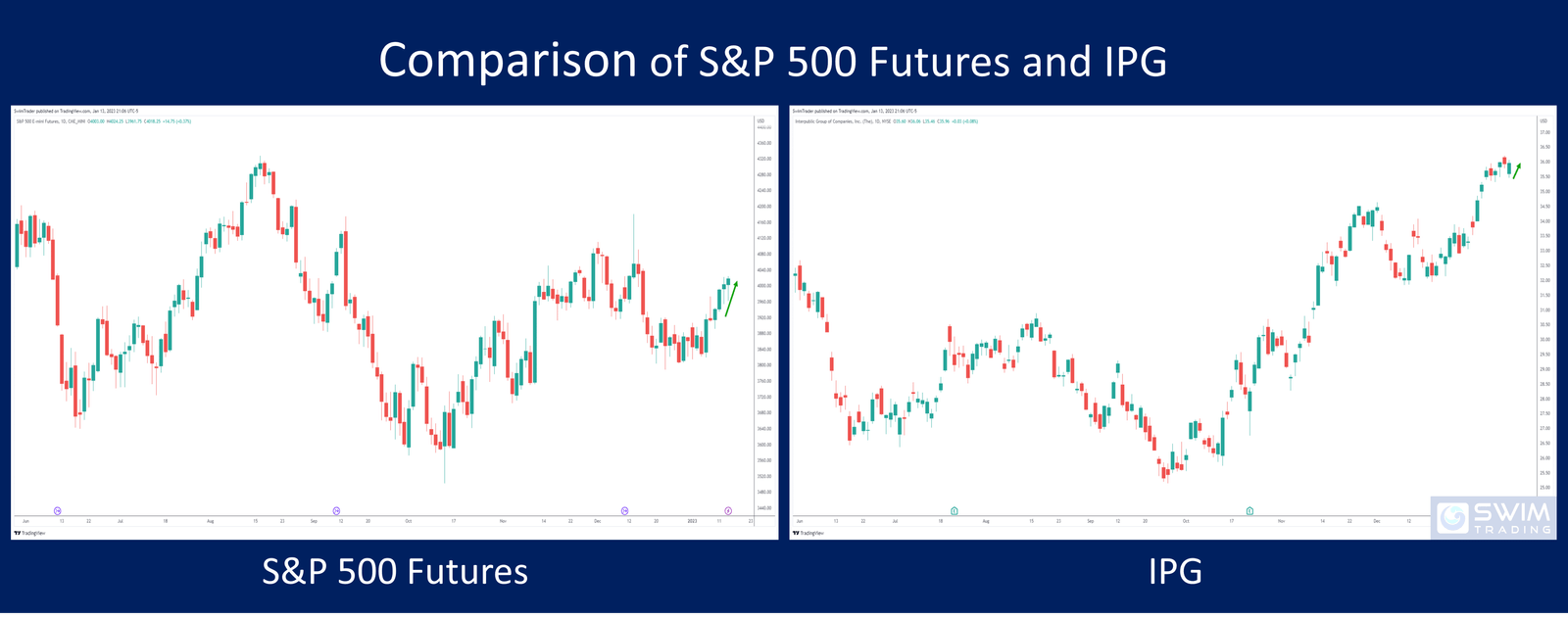

Performance Of US Stock Market vs The Interpublic Group (IPG)

Before analyzing any stock, I highly encourage you to analyze the S&P 500 futures.

This is because the S&P 500 futures reflects the health of the overall US stock market.

How has the S&P performed in the past 7 months?

The S&P 500 futures has been ranging in the 2nd half of 2022. This is an encouraging sign.

In the past week, the S&P 500 futures was bullish, climbing 2.4%.

Has the performance of The Interpublic Group’s shares outperformed the S&P 500 futures?

While the S&P 500 futures is ranging, the share price of The Interpublic Group is in an uptrend which started in mid-Oct 2022.

Even though the share price of The Interpublic Group had only risen by 0.5% last week, it has been outperforming the S&P 500 futures.

This is a powerful sign, suggesting that the bullish momentum is highly likely to continue.

But, is swing trading the shares of The Interpublic Group worth it?

To answer this question, let’s have a look at its past bullish moves to determine whether swing trading The Interpublic Group’s shares is worth your time.

How Explosive Is The Interpublic Group (IPG)?

Have the shares of The Interpublic Group been explosive to for a swing trade top be worth your time?

Each up move measures at least 5.4%, with the largest measuring 15.4%. This is exactly the sort of price action you want for your swing trades as your reward is likely to be significant.

Furthermore, The Interpublic Group boasts of having a market capitalization of almost $14b!

Ok, The Interpublic Group passes the test of being a worthy candidate for a swing trade.

Is it time to buy its shares now?

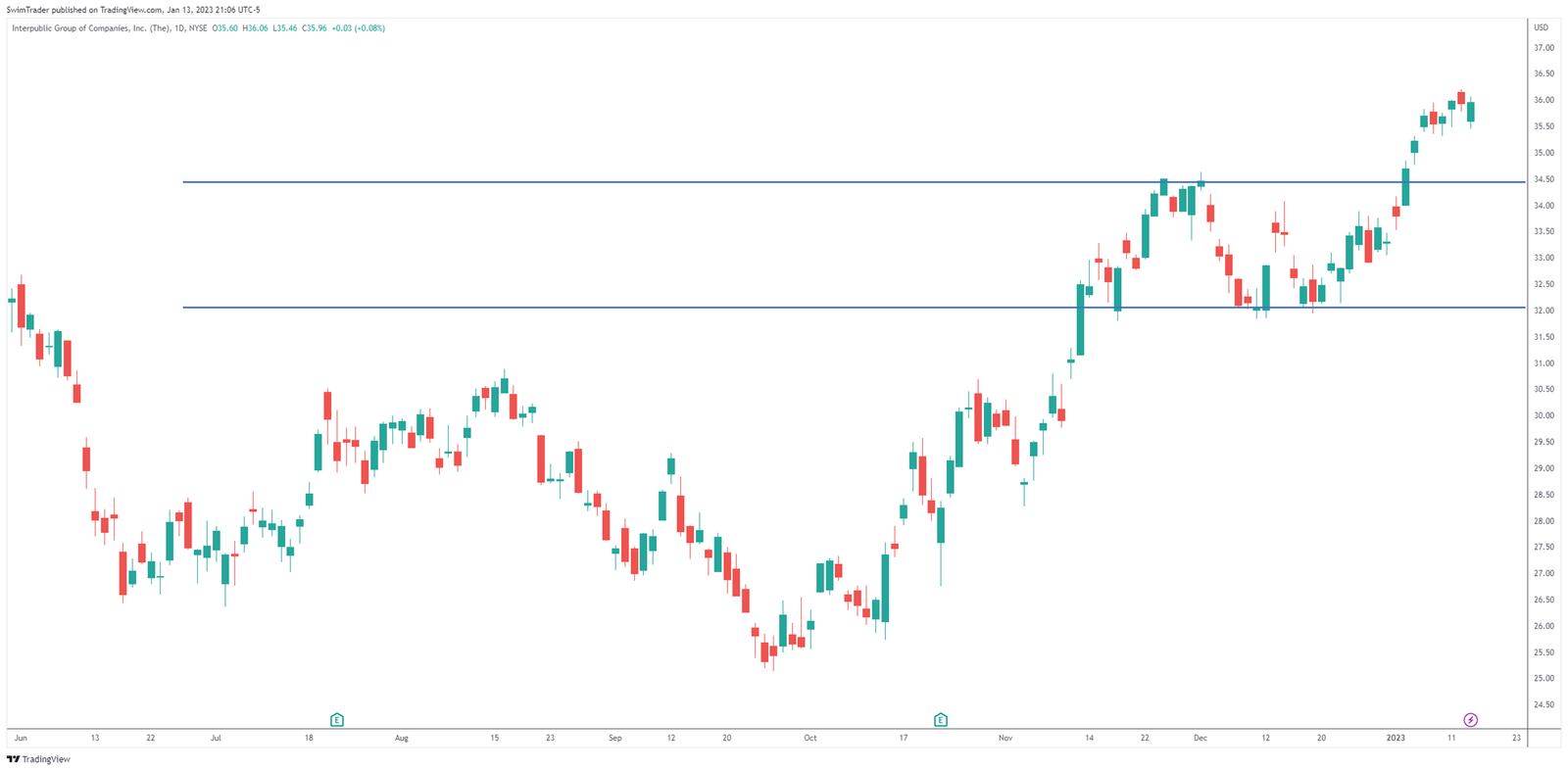

Key Price Levels

As the share price of The Interpublic Group continues to rise, let’s prepare for a swing trading opportunity which may come in the next few days.

This brings us to the next stage of analysis: identifying its key price levels.

Yes, key price levels are also known as support and resistance.

Knowing that there’s an immediate support zone at $34.50 and another support zone at $32, I wouldn’t want to buy the shares of The Interpublic Group for a swing trade now.

I’d wait for the share price of The Interpublic Group to fall to around $34.50 and re-evaluate it based on its price action.

The Strategy You Can Use To Swing Trade The Interpublic Group (IPG)

After comparing the performance of IPG with the broader US stock market, determining whether IPG has experienced explosive up moves, and identifying its key price levels, it’s time to talk strategy.

To stay in business, you must know your entry, profit taking, and stop loss levels in every trading strategy. Yes, trading is a business, which means that your strategy must be well thought out.

Using The Art of Explosive Profits (AEP) framework, I’d like to see IPG pullback to ~$34.50 before considering an entry for a swing trade.

As the name implies, you’ll be looking to consistently catch an explosive move in a short period of time.

Instead of relying on news and hearsay, the AEP course will teach you how to screen stocks for swing trading like IPG.

You’ll also learn how to read charts and identify stocks that are about to make a big move.

Finally, you’ll learn how to identify the optimal entry, stop loss, and take profit levels to capitalize on these explosive moves (in a safe manner, of course)!

Can you apply the AEP framework to provide you with a side income while working full time?

Yes, you can!

Come, have a look at the AEP framework and incorporate this explosive trading strategy to your arsenal to capitalize on more swing trading opportunities.

Why Is Swing Trading IPG Worth It?

Source: interpublic.com

IPG ticks all the boxes required for an excellent swing trade.

It has been consistently performing stronger than the overall US stock market.

In addition, its up moves have been explosive, ranging between 5.4% and 15.4%, making it a worthwhile candidate for a swing trade.

Hang on!

We are waiting for a particular scenario to play out before buying its shares for a quick swing trade either using cash or CFD.

Yes, we are waiting for a pullback to around $34.50.

While I await the opportunity, please keep in mind that I’m not a financial advisor, so please treat this as edutainment and conduct your own research.

Lastly, all photos and images are from unsplash.com, pexels.com, pixabay.com, and tradingview.com.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group where we discuss the various ways of applying this by clicking here

#2 Never miss another market update; get it delivered to you via Telegram by clicking here

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Trade safe!