Is this for real?

The S&P 500 had its best week yet in 2023, climbing 5.85%!

While many tech stocks flew, this was eclipsed by the 15.9% jump in this week’s swing trading opportunity.

Just before we jump in, it’s always a good idea to perform a short review of last week’s swing trading opportunity: NextEra Energy (NEE).

The share price had indeed pulled back to ~$55 before taking off.

By following The Art of Explosive Profits, you’ve entered the trade, and you’ll be up by more than 2%.

Congrats!

Ok, let’s have a peek into the near future and discover why PulteGroup (PHM) is our swing trading candidate.

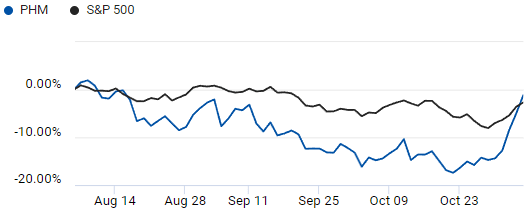

Performance Of US Stock Market vs PulteGroup (PHM)

How does the performance of PulteGroup’s shares stack up against the S&P 500?

For a couple of brief moments, its performance was stronger than the S&P 500’s, notable in early and mid-Aug 2023.

However, its shares have been outperforming the S&P 500 in the past week.

That’s not all.

Did you notice that the share price of PulteGroup is in an uptrend while the S&P 500 continues its 3-month fall in value?

Now that you can conclude that the performance of PulteGroup’s shares is much stronger, let’s go deeper.

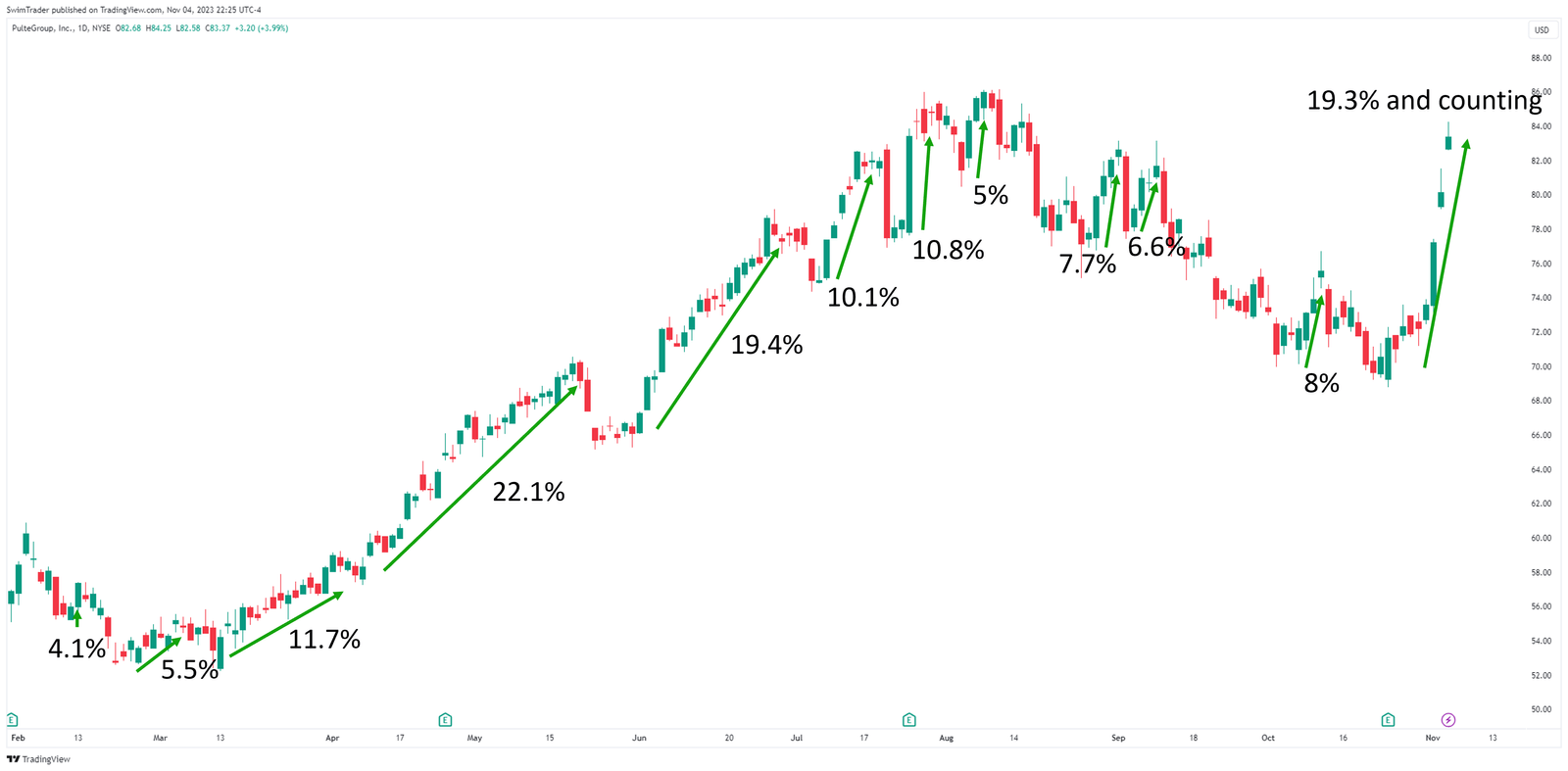

How Explosive Is PulteGroup (PHM)?

Have the shares of PulteGroup been exploding in price recently?

Knowing this characteristic will help you decide whether this stock is worth your time and money. I’m sure you won’t want your hard-earned money to be stuck in a languishing counter.

Saving you precious time, I’ve marked out all the upmoves and measured the magnitude of every one of them.

In the past 9 months alone, PulteGroup’s shares have skyrocketed 12 times!

Each of these upmoves measures between 4.1% and 22.1%. Such a result is highly impressive considering that this is a huge company with a market capitalization of nearly $18b.

Given that its latest burst up has crossed 19%, would it be wise to buy its shares for a swing trade now?

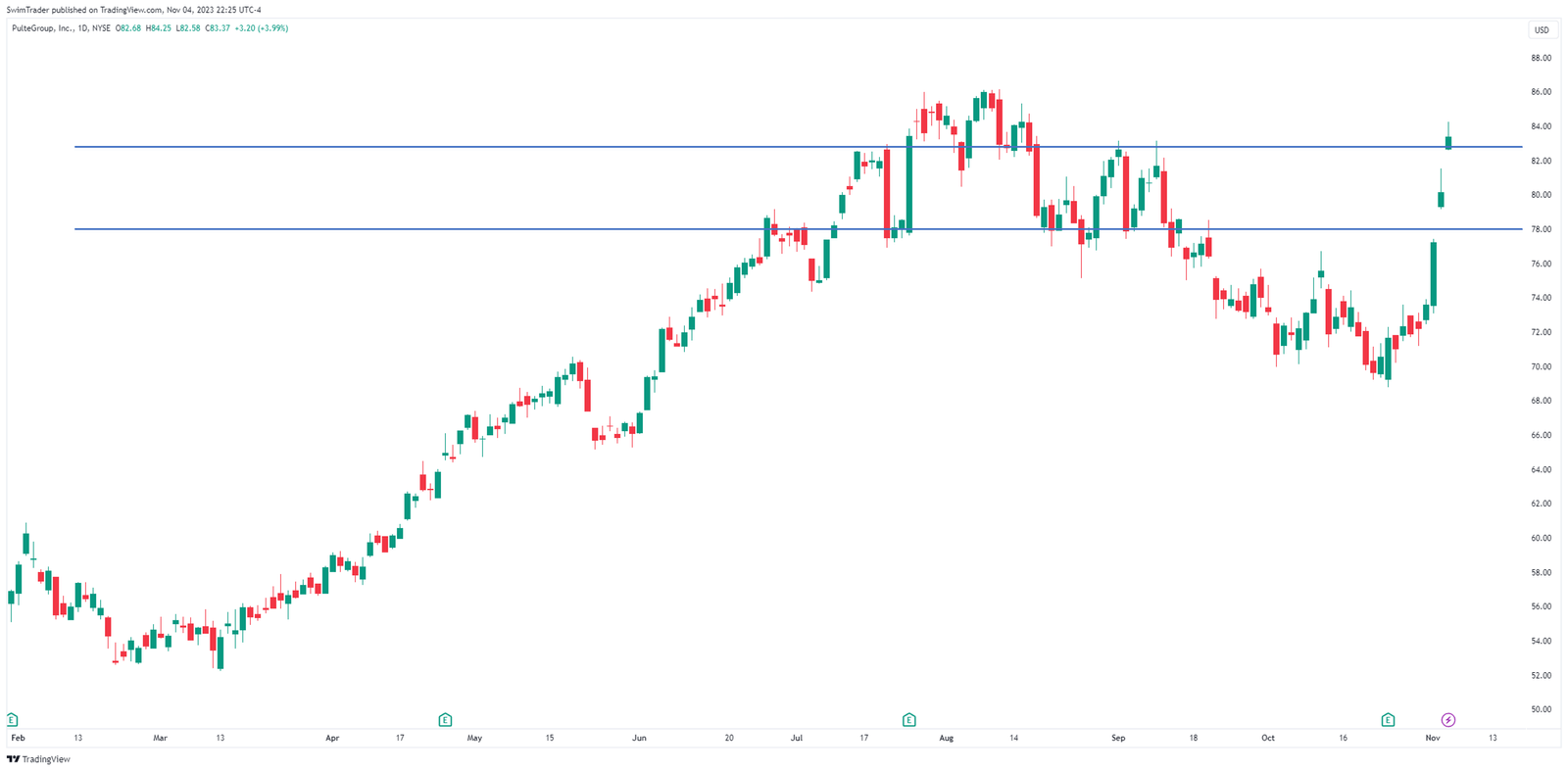

Key Price Levels

Knowing the key price levels of any counter will help you avoid paying more than what’s necessary most of the time.

These key price levels also act as support and resistance zones, which are helpful for identifying buying and selling areas.

Marking out the key price levels of PulteGroup’s shares, you can see that there are 2 support areas to pay attention to.

While the share price of PulteGroup is sitting above its immediate support area of ~$82.50, I don’t think that this key price level is likely to hold.

Its share price is more likely to fall and reach ~$78 before rising again.

Therefore, I’ll be watching this support area closely before taking action.

The Strategy You Can Use To Swing Trade PulteGroup (PHM)

After comparing the performance of PHM with the broader US stock market, determining whether PHM has experienced explosive up moves, and identifying its key price levels, it’s time to talk strategy.

To stay in business, you must know your entry, profit-taking, and stop loss levels in every trading strategy. Yes, trading is a business, which means that your strategy must be well thought out.

Using The Art of Explosive Profits (AEP) framework, I’d like to see PHM pullback and bounce at $78 before considering an entry for a swing trade.

As the name implies, you’ll be looking to consistently catch an explosive move in a short period of time.

Instead of relying on news and hearsay, the AEP course will teach you how to screen stocks for swing trading like PHM.

You’ll also learn how to read charts and identify stocks that are about to make a big move.

Finally, you’ll learn how to identify the optimal entry, stop loss, and take profit levels to capitalize on these explosive moves (in a safe manner, of course)!

Can you apply the AEP framework to provide you with a side income while working full time?

Yes, you can!

Come, have a look at the AEP framework and incorporate this explosive trading strategy into your arsenal to capitalize on more swing trading opportunities.

Why Is Swing Trading PHM Worth It?

Source: pultegroup.com

PHM is trending higher and has been outperforming the stock market in the past week.

Its price movement has proven to be explosive, capable of upmoves between 4.1% and 22.1%.

Having flown 19.3%, you should be better off waiting for a pullback before firing your order for a swing trade.

While you wait for the setup, please keep in mind that I’m not a financial advisor, so please treat this as infotainment and conduct your own research.

Lastly, all images are from pexels.com, pixabay.com, sectorspdrs.com, tradingview.com, and unsplash.com.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group where we discuss the various ways of applying this by clicking here.

#2 Get market updates delivered to you via Telegram by clicking here.

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here.

Trade safe!