How has the technology sector (XLK) performed since the beginning of 2023?

Fantastic!

While the S&P 500 has risen by 7%, the technology sector has grown by nearly 20%!

As the technology sector pauses for a rest, many technology stocks have either consolidated or pulled back.

What’s the significance?

Technology stocks could rise in the near term.

I’d like to bring your attention to last week’s swing trading opportunity on Take-Two Interactive Software (TTWO).

As predicted, it has continued to rise, yet to trigger an entry based on The Art of Explosive Profits framework.

Let’s continue to be patient and wait for the opportunity to be present.

In the meantime, shall we analyze this swing trading opportunity in the technology sector: Fortinet?

Performance Of US Stock Market vs Fortinet (FTNT)

When you are selecting a stock for swing trading, you’ll want a stock that’s beating the market for a higher return.

Looking at the comparison chart of the S&P 500 and Fortinet above, have the shares of Fortinet performed better?

Yes!

What’s another observation that you can make?

The share price of Fortinet is in an uptrend and it pulled back last week.

Pullbacks are usually great entry points for swing trades. But, there are a couple more steps to analyze the shares of Fortinet before a conclusion can be reached.

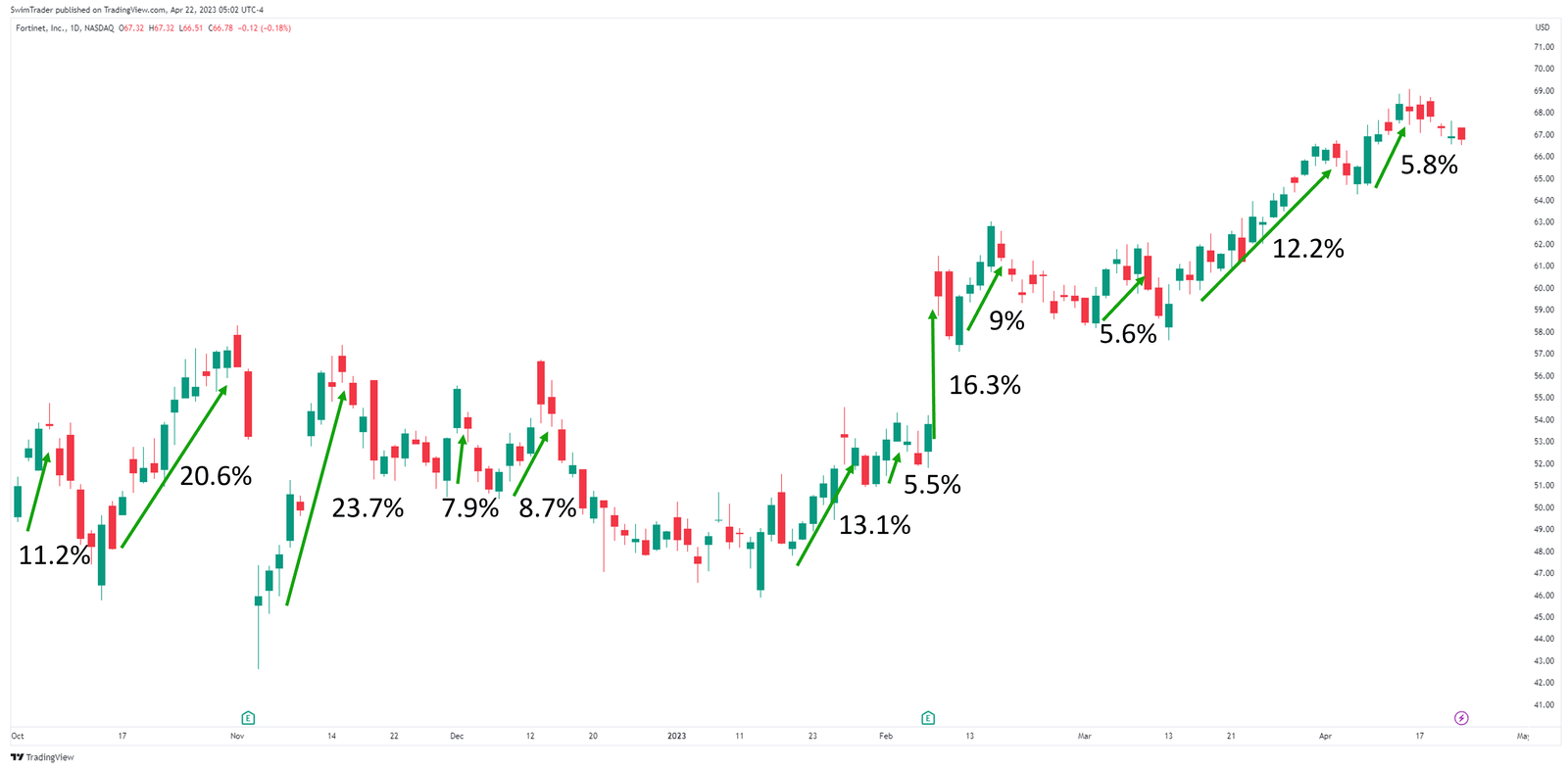

How Explosive Is Fortinet (FTNT)?

When there are numerous opportunities in the stock market for a swing trade, you want the stock that you’re considering to be explosive in nature.

In the past 6 months, the shares of Fortinet have made 12 explosive up moves, with the largest measuring 23.7%!

For a company with a market capitalization of over $52b, this is mind-blowing!

Knowing that you could be rewarded handsomely for swing trading its shares, let’s proceed to the next step of our analysis.

Key Price Levels

At this stage, you’ll be looking for a good entry price.

Therefore, it’s necessary to identify the key price levels (or support and resistance zones) of Fortinet’s shares.

Looking at its price chart, you can see an immediate resistance zone at ~$68.

Because its share price has been pulling back, I’d like to see it rise past $68 in the coming days for an entry.

If its shares get rejected once more at ~$68, that’s a signal that Fortinet’s shares aren’t likely to explode upwards.

The Strategy You Can Use To Swing Trade Fortinet (FTNT)

After comparing the performance of FTNT with the broader US stock market, determining whether FTNT has experienced explosive up moves, and identifying its key price levels, it’s time to talk strategy.

To stay in business, you must know your entry, profit taking, and stop loss levels in every trading strategy. Yes, trading is a business, which means that your strategy must be well thought out.

Using The Art of Explosive Profits (AEP) framework, I’d like to see FTNT break above $68 before considering an entry for a swing trade.

As the name implies, you’ll be looking to consistently catch an explosive move in a short period of time.

Instead of relying on news and hearsay, the AEP course will teach you how to screen stocks for swing trading like FTNT.

You’ll also learn how to read charts and identify stocks that are about to make a big move.

Finally, you’ll learn how to identify the optimal entry, stop loss, and take profit levels to capitalize on these explosive moves (in a safe manner, of course)!

Can you apply the AEP framework to provide you with a side income while working full time?

Yes, you can!

Come, have a look at the AEP framework and incorporate this explosive trading strategy to your arsenal to capitalize on more swing trading opportunities.

Why Is Swing Trading FTNT Worth It?

![]()

Source: fortinet.com

Fortinet is in the technology sector which has been consistently outperforming the S&P 500 since the beginning of 2023.

This strong performance is also reflected in the shares of Fortinet, indicating that this bullish momentum could continue.

Besides, the shares of Fortinet have proven to be explosive in nature, rising as much as 23.7% in the past 6 months. By swing trading its shares, your money is likely to be working hard for you.

While we wait for the breakout and pullback, please keep in mind that I’m not a financial advisor, so please treat this as edutainment and conduct your own research.

Lastly, all images are from pexels.com, pixabay.com, sectorspdrs.com, tradingview.com, and unsplash.com.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group where we discuss the various ways of applying this by clicking here.

#2 Get market updates delivered to you via Telegram by clicking here.

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here.

Trade safe!