Saudi Arabia is the hottest place on earth now.

For soccer.

The current king of soccer, Karim Benzema, has moved to Saudi Arabia, to compete with Cristiano Ronaldo.

Lionel Messi was also courted by Saudi Arabia, but he chose to move to the US instead.

The US stock market is full of blockbusters too!

Shares of Tesla flew upon the news of GM joining its supercharging network, in addition to other great news.

As the US stock market continues to be buoyant, last week’s swing trading opportunity – ANSYS (ANSS), looks to be almost ripe.

The trading plan is still valid and I’m watching ANSS like a hawk.

What’s the swing trading opportunity for this week?

Let’s analyze D R Horton together.

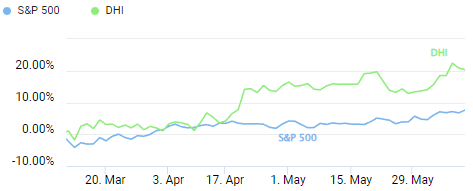

Performance Of US Stock Market vs D R Horton (DHI)

Why is comparing the performance of D R Horton’s shares against the S&P 500 important?

When you’re looking to buy a stock for a short-term trade, especially swing trade, you’ll want your stock to beat the market. If not, you’ll be better off swing trading the S&P 500.

This helps to increase your chance of success too.

Can you also tell that the shares of D R Horton are in an uptrend?

Knowing that the shares of D R Horton is in an uptrend and has been beating the market, let’s proceed to analyze its shares further.

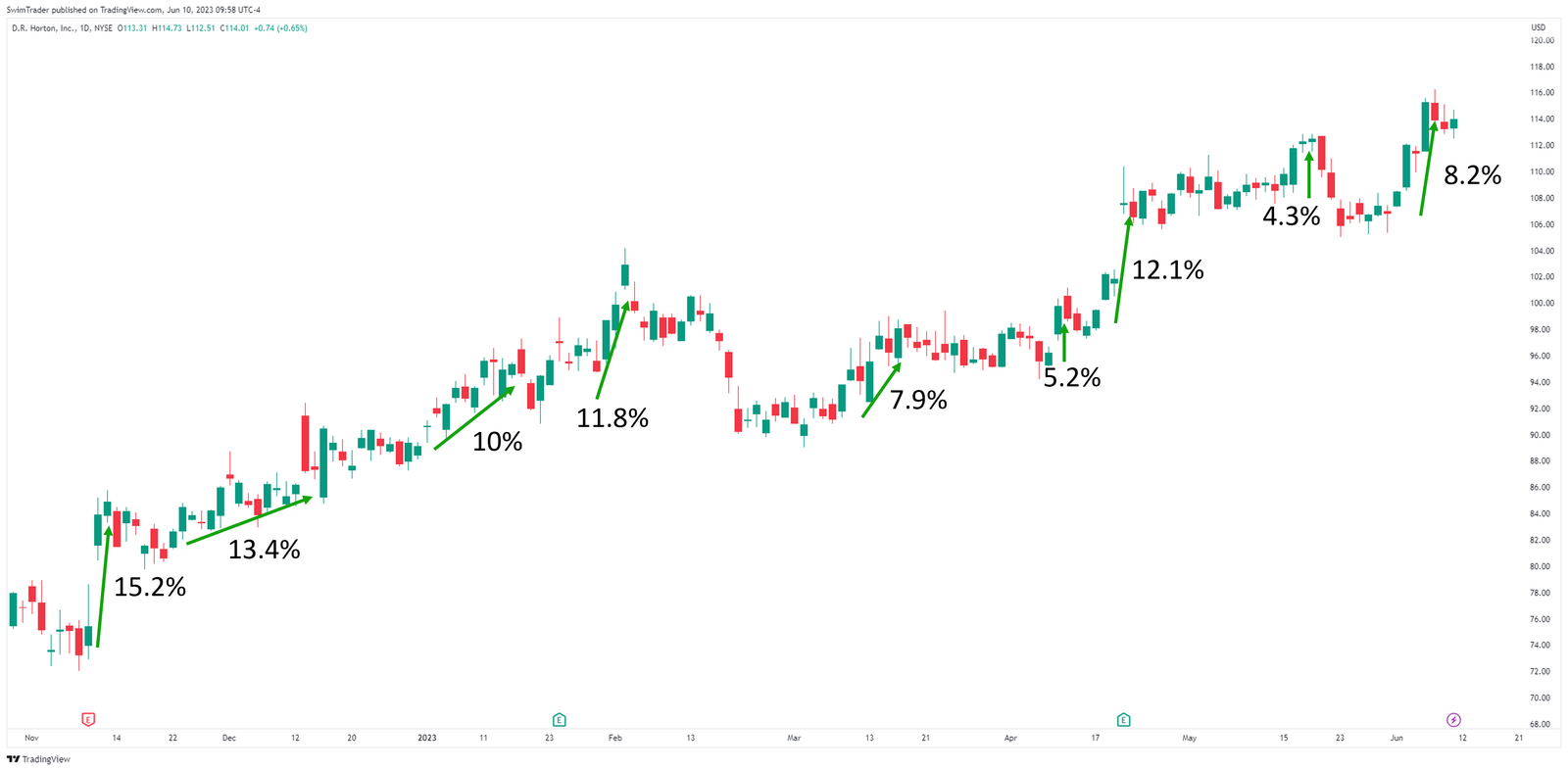

How Explosive Is D R Horton (DHI)?

Have the up moves on the shares of D R Horton been explosive?

Between Nov 2022 and June 2023, there have been 9 explosive up moves.

Each of these up moves measure between 4.3% and 15.2%!

These up moves are significant given that D R Horton enjoys a huge market capitalization of $38b.

Ok, so you’ve uncovered that the up moves of D R Horton’s shares are explosive enough to make your swing trade worthwhile. What’s next?

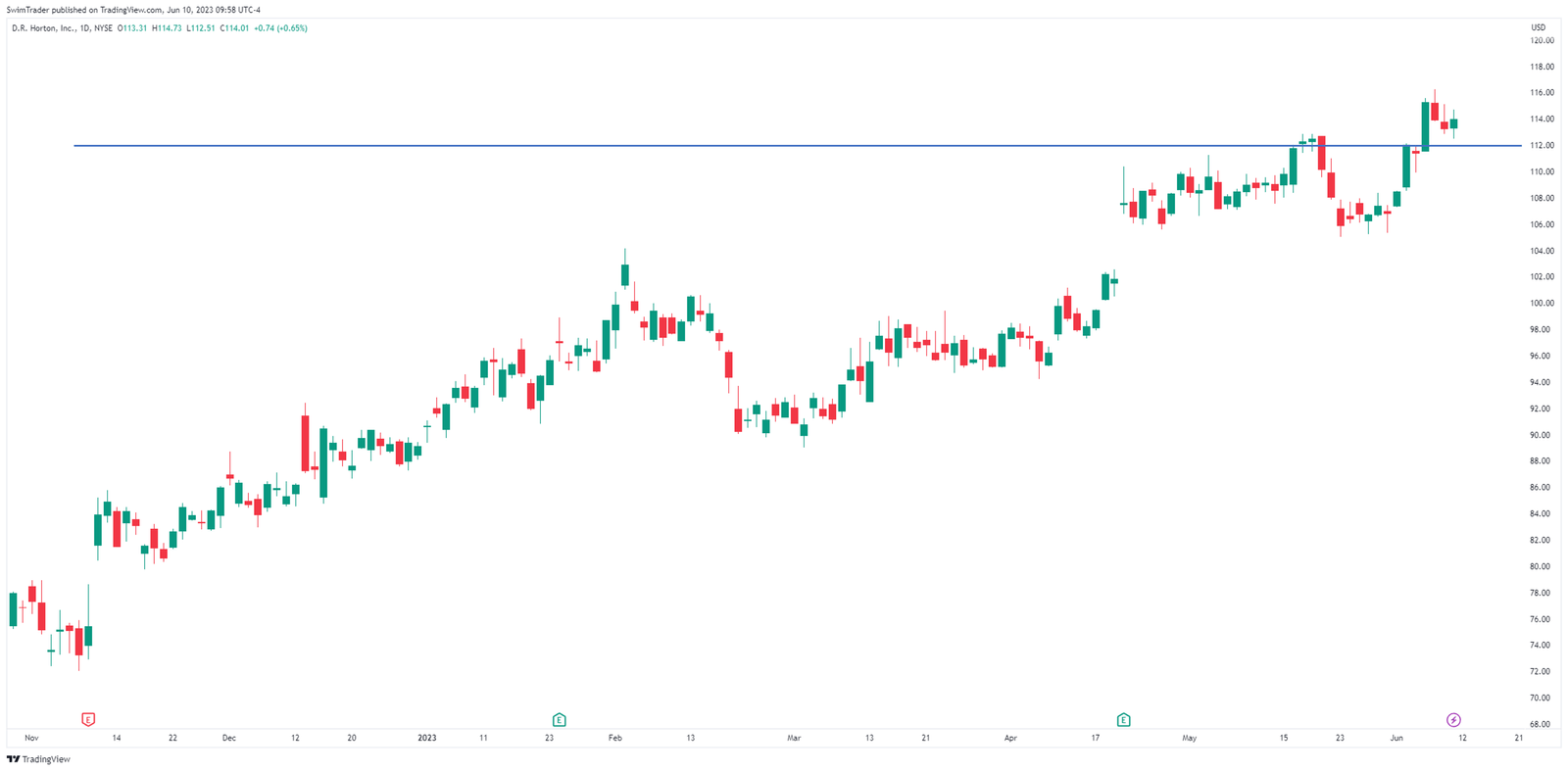

Key Price Levels

There’s a trick to improve your win rate in swing trading – plotting the key levels of the stock you’re watching.

Key price levels act as support and resistance zones, where prices are likely to turn.

Hence, you’ll want to buy a stock if its share price is near its support zone.

Referring to the chart of D R Horton above, I’ve marked out its immediate support zone at ~$112.

This means that I’m waiting for its share price to drop slightly further before considering an entry for a swing trade.

The Strategy You Can Use To Swing Trade D R Horton (DHI)

After comparing the performance of DHI with the broader US stock market, determining whether DHI has experienced explosive up moves, and identifying its key price levels, it’s time to talk strategy.

To stay in business, you must know your entry, profit taking, and stop loss levels in every trading strategy. Yes, trading is a business, which means that your strategy must be well thought out.

Using The Art of Explosive Profits (AEP) framework, I’d like to see DHI fall further to $112 before considering an entry for a swing trade.

As the name implies, you’ll be looking to consistently catch an explosive move in a short period of time.

Instead of relying on news and hearsay, the AEP course will teach you how to screen stocks for swing trading like DHI.

You’ll also learn how to read charts and identify stocks that are about to make a big move.

Finally, you’ll learn how to identify the optimal entry, stop loss, and take profit levels to capitalize on these explosive moves (in a safe manner, of course)!

Can you apply the AEP framework to provide you with a side income while working full time?

Yes, you can!

Come, have a look at the AEP framework and incorporate this explosive trading strategy into your arsenal to capitalize on more swing trading opportunities.

Why Is Swing Trading DHI Worth It?

Source: investor.drhorton.com/news-and-events/presentations/presentations-2023

An excellent swing trading candidate should be beating the market. And DHI has consistently been outperforming the S&P 500 for months.

In addition, DHI has been enjoying explosive up moves which makes it worthwhile for a swing trade.

Furthermore, DHI is near its support zone, meaning that a swing trading opportunity is near.

While we wait for the pullback, please keep in mind that I’m not a financial advisor, so please treat this as edutainment and conduct your own research.

Lastly, all images are from pexels.com, pixabay.com, sectorspdrs.com, tradingview.com, and unsplash.com.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group where we discuss the various ways of applying this by clicking here.

#2 Get market updates delivered to you via Telegram by clicking here.

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here.

Trade safe!