What did you buy on Black Friday?

Some of my friends shared photos of the long and snaking queues outside cosmetic boutiques and shoppers with multiple huge shopping bags.

Retail spending is back with a vengeance, it seems!

Did you also realize that last week’s stock pick is in the retail industry too?

The share price of Crocs has pulled back and looks almost ready to launch upwards.

I think that the party in the retail industry is only getting started, so let’s dive right in!

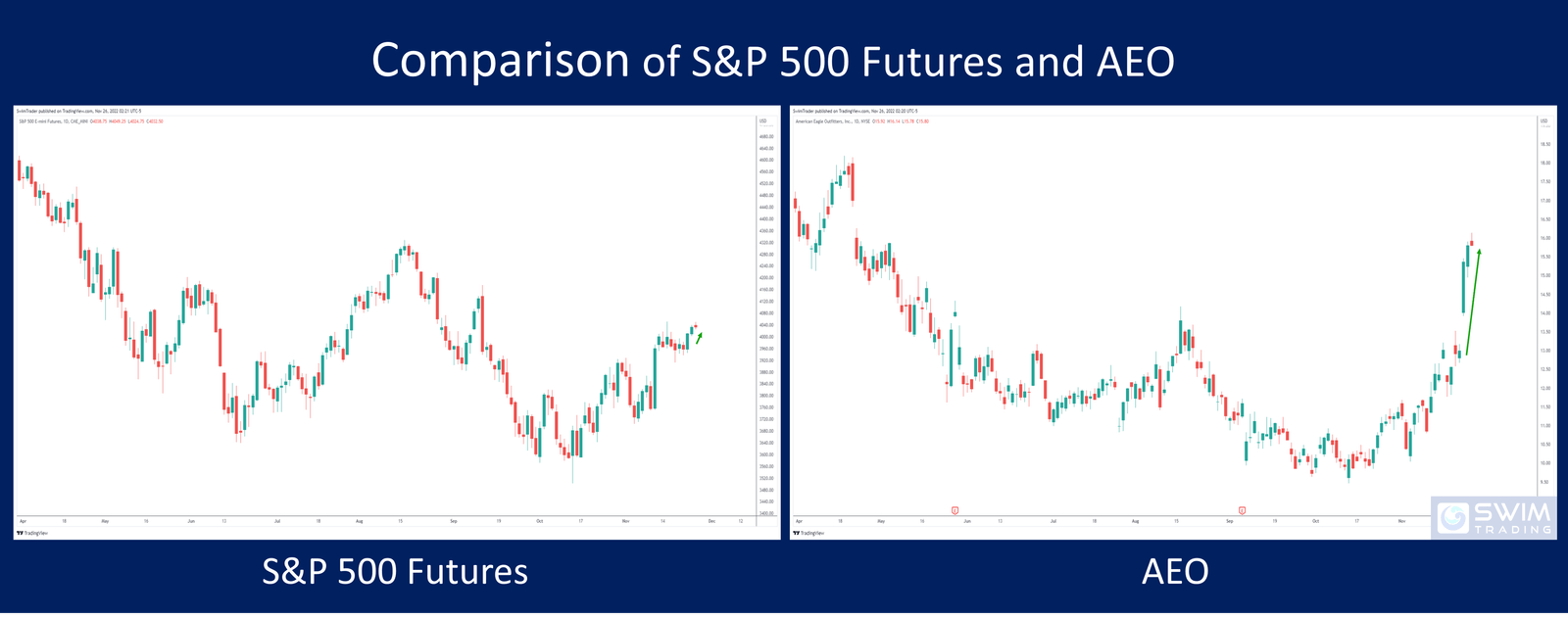

Performance Of US Stock Market vs American Eagle Outfitters (AEO)

The holiday and shopping season is here!

Before rushing to enter an order, let’s have a look if there are signs of bullishness in the S&P 500 futures.

The past week has been bullish for the S&P 500 futures. It’s even on a fine bull run since mid-Oct 2022!

But the larger question remains – are the bulls really back?

A zoomed out look of the S&P 500 futures chart shows that the bears are still in control as the S&P 500 futures is still in a downtrend.

Now, let’s compare that to the chart of American Eagle Outfitters (AEO).

In the past week, American Eagle Outfitters’ share price rocketed by 23%!

Is there a chart pattern that you can spot?

Yes! A rounding bottom.

This chart pattern adds conviction that prices should continue to rise in the next few weeks.

Because the chart of American Eagle Outfitters’ shares are in a powerful uptrend, its performance is much stronger than the S&P 500 futures’.

For a stock to be considered for a quick swing trade, another factor has to be met – its explosiveness in price.

Let’s examine if the share price of American Eagle Outfitters has proven to be explosive for a quick swing trade.

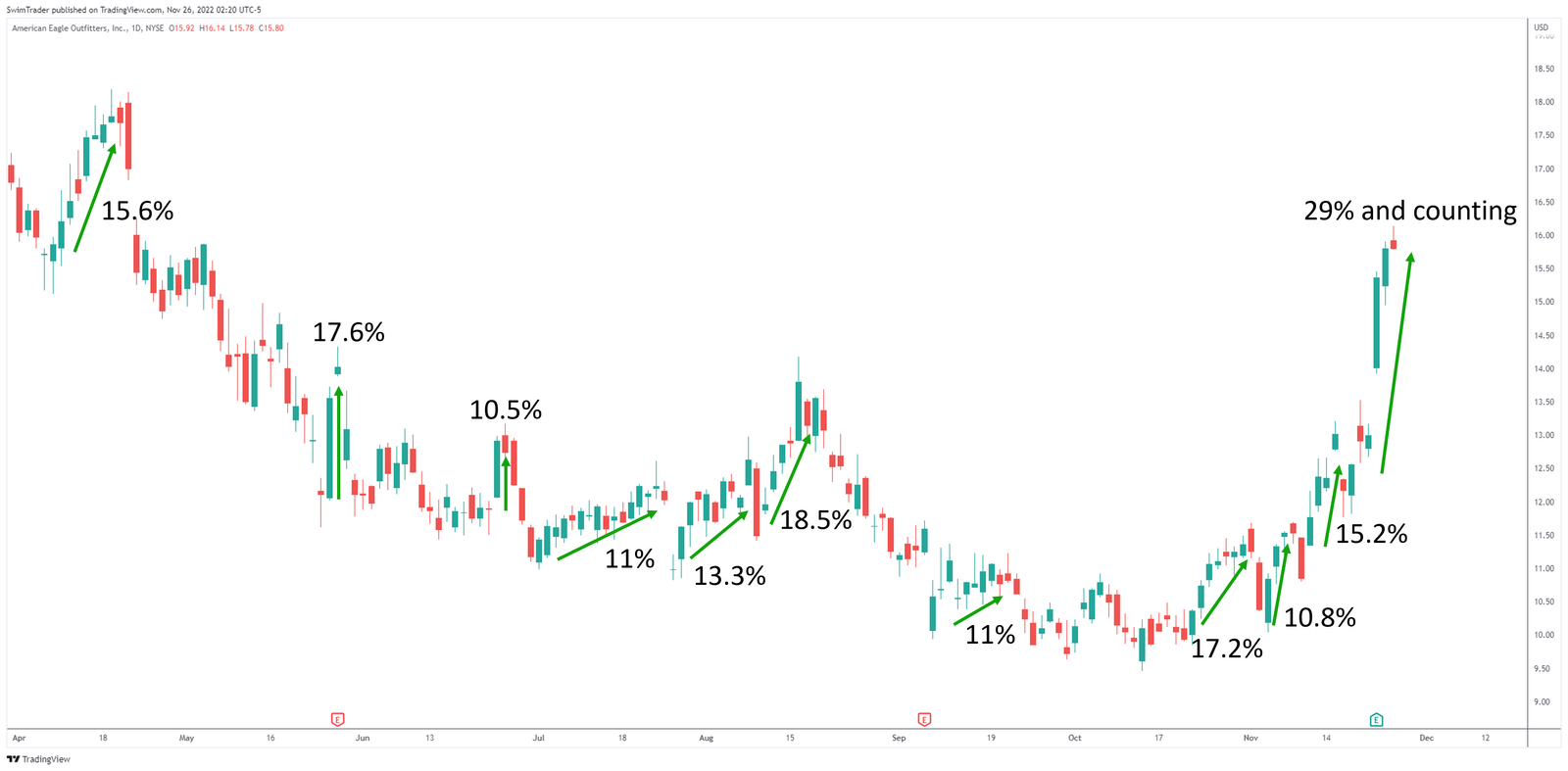

How Explosive Is American Eagle Outfitters (AEO)?

You’ll want the stock that you’re swing trading to enjoy huge explosive up moves so as to optimize your trading capital.

Afterall, you’re trading the stock market because you want your money to work for you.

Looking at the chart of American Eagle Outfitters above, you can see that its shares have been exhibiting tremendous upward momentum!

Each of its explosive up moves measures 11% or larger, with the largest move being formed now, measuring 29% and counting!

To explode in this magnitude is jaw dropping considering the $3b market capitalization American Eagle Outfitters commands.

Due to this reason, it’s worth to examine the chart of American Eagle Outfitters further.

Key Price Levels

The next step is to uncover the key price levels of American Eagle Outfitters’ shares as they are support and resistance zones.

As from the chart, you can see an immediate resistance zone at ~$18, an immediate support zone at ~$15.75, and a lower support zone at ~$13.

You’ll want to pay attention to the support zone at ~$15.75, observing if there’s sufficient demand for a continuation of its rise in price.

However, I don’t think that the support zone at ~$15.75 will hold given that the current up move is astronomical. A pullback will be healthy to prepare for its next explosive up move.

Therefore, I won’t be placing a limit buy order at ~$15.75 just yet.

The Strategy You Can Use To Trade American Eagle Outfitters (AEO)

After comparing the performance of AEO with the broader US stock market, determining whether AEO has experienced explosive up moves, and identifying its key price levels, it’s time to talk strategy.

To stay in business, you must know your entry, profit taking, and stop loss levels in every trading strategy. Yes, trading is a business, which means that your strategy must be well thought out.

Using The Art of Explosive Profits (AEP) framework, I’d like to see AEO pullback to around $15 before considering an entry.

As the name implies, you’ll be looking to consistently catch an explosive move in a short period of time.

Instead of relying on news and hearsay, the AEP course will teach you how to look for strong stocks like AEO.

You’ll also learn how to read charts and identify stocks that are about to make a big move.

Finally, you’ll learn how to identify the optimal entry, stop loss, and take profit levels to capitalize on these explosive moves (in a safe manner, of course)!

Have a look at the AEP framework and incorporate this explosive trading strategy to your arsenal to capitalize on more swing trading opportunities.

Why Is American Eagle Outfitters (AEO) The Stock Pick Of The Week?

Source: aeo.com.sg/sg_en

Don’t be misled by the recent bullish move in the S&P 500 futures. Its still in a downtrend since the beginning of 2022.

But this doesn’t mean that there’s no buying opportunities for a quick swing trade.

The shares performance of American Eagle Outfitters has improved lately, with a rounding bottom and a new uptrend formed.

Furthermore, its shares have been exhibiting and enjoying explosive up moves, a crucial trait to have when considering any stock for a swing trade. Its up moves measure between 11% and 29%, enjoying huge bullish rallies, making it a prime candidate for a quick swing trade.

While I await the opportunity, please keep in mind that I’m not a financial advisor, so please treat this as edutainment and conduct your own research.

Lastly, all photos and images are from unsplash.com, pexels.com, pixabay.com, and tradingview.com.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Join us in our Facebook Group where we discuss the various ways of applying this by clicking here

#2 Never miss another market update; get it delivered to you via Telegram by clicking here

#3 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Trade safe!