Were you surprised by the sudden drop in technology stocks?

Nasdaq is primarily composed of technology stocks.

And the Nasdaq futures provide invaluable clues to the direction most technology stocks would be heading towards.

Last week, the Nasdaq futures dropped from 20,797 to below 20,000 in a week (nearly 4%)!

I think that there’s more to come as shared with my community in Facebook, so be prepared!

Switching gears, how did last week’s stock pick, Zscaler (ZS), perform?

Review Of Last Week’s Pick Of The Week

Zscaler (ZS) was our #PowerStocks pick for last week.

After a downtrend from mid-Feb to late Mar 2024, market participants turned optimistic on the shares of Zscaler.

This has brought its shares to my radar.

As soon as the share price of Zscaler pulled back by 5.7% in early Jul 2024, it was reasonable to expect its share price to explode upwards.

But this was not to be the case.

This is when a stop loss is handy, protecting your hard-earned money.

Are you ready to analyze this week’s stock pick: Jefferies Financial (JEF)?

Why Is Swing Trading Jefferies Financial (JEF) Worth It?

Source: jefferies.com

Jefferies Financial is a financial institution that provides investment banking and capital markets solutions, and asset management services.

Its shares are highly favored, evident from its 70.2% rise from Nov 2023.

Undoubtedly, its shares have consistently outperformed the S&P 500, as much as 3x!

And it gets even better!

Its share price has been pulling back lately, paving the way for its next explosive upmove.

What’s the game plan?

Continue reading to get the details.

P.S. What if I told you that you could drastically gain control over your emotions of fear and greed, and master the stock market in a short amount of time?

My team and I have worked tirelessly to help you achieve results fast.

Click on the banner below to claim your stock course for free (limited time) now!

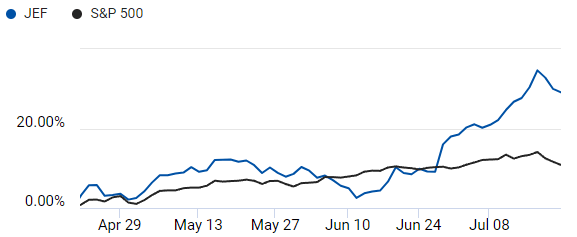

Performance Of US Stock Market vs Jefferies Financial (JEF)

Can you tell the trend of Jefferies Financial’s shares?

Its share price has been in a strong uptrend since mid-June 2024, so you’ll want to look for buying opportunities.

Does this mean that the shares of Jefferies Financial are an excellent candidate to buy?

To increase your odds of success, you’ll want its performance to be stronger than the overall US stock market (aka S&P 500).

Referring to the comparison chart above, it’s clear that the performance of Jefferies Financial’s shares has beaten the S&P 500’s by a wide margin.

How wide?

Jefferies Financial’s shares rose nearly 30%, while the S&P 500 rose 10.8%. That’s close to a 3x outperformance!

Yes, with such a strong performance, you can expect Jefferies Financial’s shares to continue shining.

Therefore, shall we continue to analyze its shares?

How Explosive Is Jefferies Financial (JEF)?

When you are looking to buy any stock for a swing trade, here’s a consideration: How explosive has its share price been?

Jefferies Financial enjoys a market capitalization of $11b. Yet, its share price movement has been nothing short of explosive.

In the past 11 months, Jefferies Financial’s shares have experienced 14 huge upmoves, ranging between 5% to an eye-popping 24.8%!

Isn’t it heartening to know that its shares can bring outsized returns in a short amount of time?

Now, let’s determine whether the time to buy the shares of Jefferies Financial for a swing trade is ripe.

Key Price Levels

Flashing out the key price levels of Jefferies Financial’s shares helps you know whether the time to buy them for a swing trade is ripe because they act as support and resistance zones.

Did you also uncover these 2 key price levels – $53 and $56.50?

Given that the market is still retreating, its share price will likely continue pulling back.

So, it would be better to wait for its share price to drop to around $53 and bounce before buying it for a swing trade. Patience is a virtue.

Lastly, here’s a pro tip: Instead of staring at your screen, you may want to set a price alert on your broker’s platform to be notified so that you can spend precious time with your loved ones.

Finally, this is for educational purposes. Please perform your due diligence.

All images are taken from royalcaribbean.com, pexels.com, pixabay.com, sectorspdrs.com, tradingview.com, and unsplash.com, unless otherwise mentioned.

Claim Your Free (Limited Time) Stock Course Right Now:

The stock market is full of traps laid out by professional traders.

Many new traders are often left confused by conflicting signs and signals.

Worse still, ~80% of traders lose money.

This is because trading isn’t just about skill alone.

It includes the mastery of your emotions.

But what if I told you that you could quickly gain control over your emotions of fear and greed and master the stock market?

My team and I have worked tirelessly to help you achieve results fast.

Click on the banner below to claim your stock course for free (limited time) now!