Has it always been this hot in summer?

Or is it due to global warming?

Some countries face torrential rains and other natural disasters, leading to floods.

Infrastructure has been weakened, with sinkholes appearing in major cities such as Kuala Lumpur and Seoul.

Let’s continue doing our part by being more environmentally aware and conscious.

Also, shall we review the performance of our #PowerStocks picks shared in Aug 2024?

- AbbVie: Gain of 5.4%

- PPL: No entry

- WEC Energy: Gain of 3.5%

- Extreme Networks: No entry

- Evolent Health: No entry

The S&P 500 had a wild ride in Aug 2024. It had dropped 7.6% before recovering to close higher.

In Aug, the S&P 500 had gained a respectable 2.3%.

However, if you’d followed the #PowerStocks picks shared in Aug, you’d be up by 4.4%!

Yes, that’s almost 2x more than the returns the S&P 500 had brought.

Are you curious how I’ve uncovered these explosive stocks that consistently outperform the stock market?

I share the framework in my masterclass, The Art of Explosive Profits. Join hundreds of students and enjoy profiting from the market repeatedly, safely, of course!

Let’s review last week’s stock pick: Evolent Health (EVH).

Review Of Last Week’s Pick Of The Week

Evolent Health (EVH) was our #PowerStocks pick last week.

It’s a healthcare company whose share price has been rising fast and hard in the past few months.

Its resistance area of around $33 proved strong, and its share price fell after reaching that region.

However, I think that this pullback is about to continue.

I’m waiting for it to pull back to around $29.50 and bounce before I consider buying its shares for an explosive swing trade.

This week’s stock pick is in this sector that has been outperforming the S&P 500 for months! And it is shared in my Telegram Channel.

Please note that my team and I WILL NEVER solicit for any investment.

A list of our official communication channels can be found here.

Ok, shall we now analyze this week’s stock pick: Iron Mountain (IRM)?

Why Is Swing Trading Iron Mountain (IRM) Worth It?

Source: investors.ironmountain.com/overview/default.aspx

Iron Mountain is a real estate investment trust (REIT) with data centers worldwide.

Its share price has been consistently outperforming the S&P 500. While the S&P 500 had brought traders a return of 7.8% in the last 3 months, Iron Mountain has brought its traders a whopping 42.2% return!

Unsurprisingly, its share price has risen an astonishing 61.8% year-to-date.

Instead of feeling the fear of missing out, a swing trading opportunity could present itself soon as its share price has just begun to pull back.

What’s the game plan?

Continue reading to get the details.

P.S. What if I told you that you could drastically gain control over your emotions of fear and greed, and master the stock market in a short amount of time?

My team and I have worked tirelessly to help you achieve results fast.

Click on the banner below to claim your stock course for free (limited time) now!

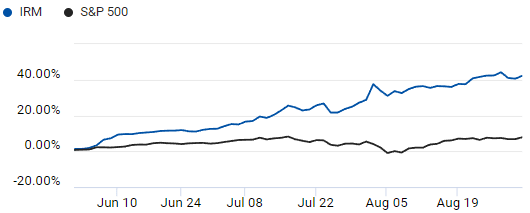

Performance Of US Stock Market vs Iron Mountain (IRM)

Did you know that the share price of Iron Mountain has risen by 61.8% year-to-date?

A bulk of this astonishing had occurred in the last 3 months. As the S&P 500 rose 7.8%, Iron Mountain’s share price rose 42.2% (an eye-popping 5.4x faster)!

With its share price also in a firm uptrend, you’ll want to look for buying opportunities to grow your money fast and safely.

So, let’s analyze its shares further.

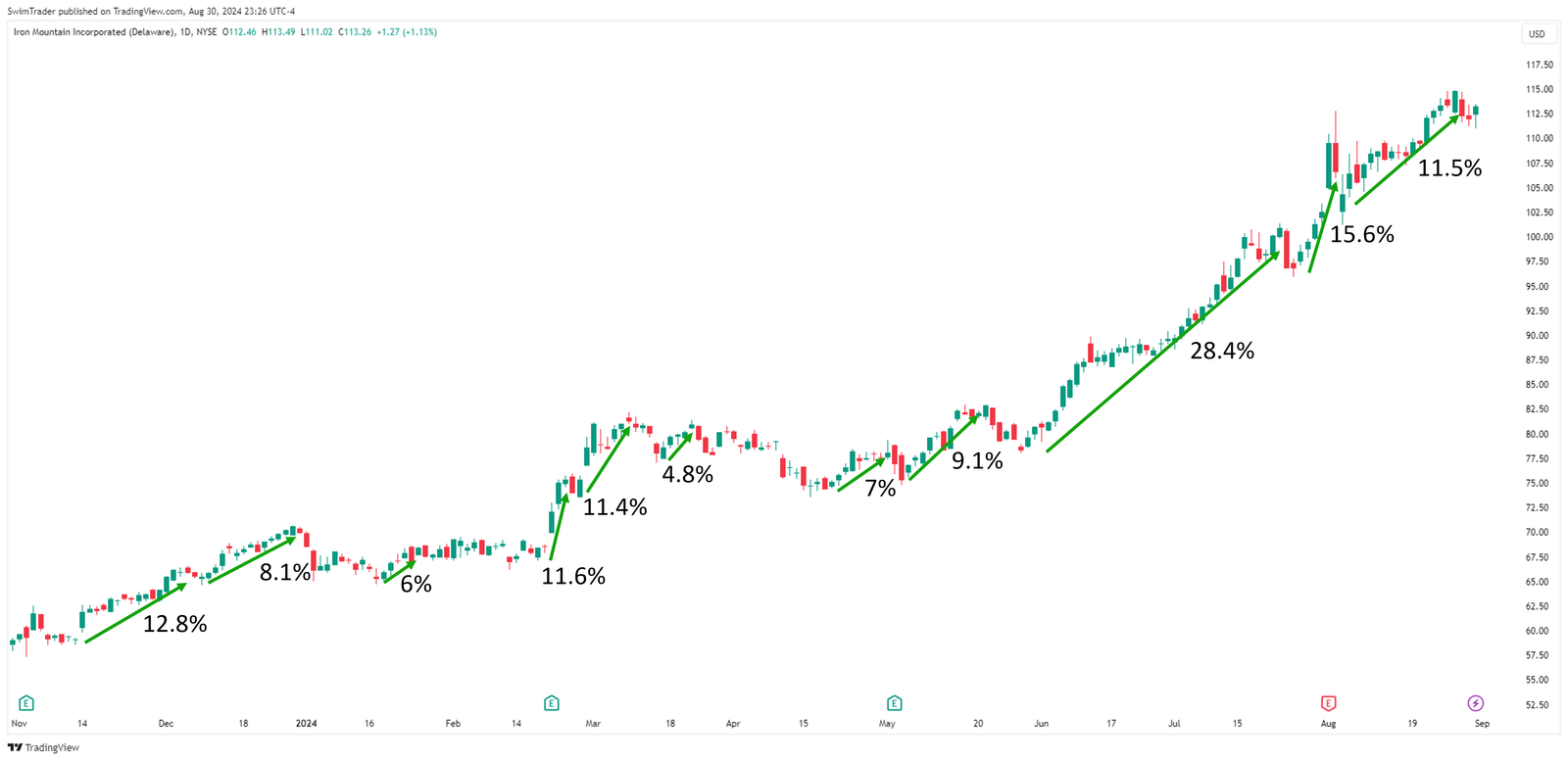

How Explosive Is Iron Mountain (IRM)?

Although Iron Mountain’s share price has risen 61.8% year-to-date, are its upmoves sufficiently explosive for a swing trade?

In the past 10 months, its share price has exploded upwards 11 times!

Measuring between 4.8% and 28.4%, these upmoves are insane, especially when this is a $32.8b REIT.

Buying the shares of Iron Mountain is thus highly likely an efficient use of your trading capital.

But should you buy its shares for an explosive swing trade now?

Key Price Levels

It’s a good idea to uncover its key price levels. They are also known as support and resistance.

Did you spot a support area around $109?

Because prices tend to turn at support and resistance areas, you’ll want to wait for its share price to fall to ~$109 and bounce before buying its shares for a swing trade.

That’s precisely what I’ll be waiting for as well!

Here’s a pro tip: Instead of staring at your screen, you may want to set a price alert on your broker’s platform to be notified so that you can spend precious time with your loved ones.

Finally, this is for educational purposes. Please perform your due diligence.

All images are taken from pexels.com, pixabay.com, sectorspdrs.com, tradingview.com, and unsplash.com, unless otherwise mentioned.

Claim Your Free (Limited Time) Stock Course Right Now:

The stock market is full of traps laid out by professional traders.

Many new traders are often left confused by conflicting signs and signals.

Worse still, ~80% of traders lose money.

This is because trading isn’t just about skill alone.

It includes the mastery of your emotions.

But what if I told you that you could quickly gain control over your emotions of fear and greed and master the stock market?

My team and I have worked tirelessly to help you achieve results fast.

Click on the banner below to claim your stock course for free (limited time) now!