Did COVID-19 hit the property market hard?

Did the price of commercial real estate drop? Did the vacancy rate shoot up?

It’s natural for you to ask these questions as you form your investment decision. While the price of commercial real estate and vacancy rates are important, there’re 7 other more important factors to look at when assessing an investment in real estate.

You’ll have to consider if you want to own and manage a piece of real estate too – respond to enquiries, market the space, respond to emergencies in the middle of the night, negotiate contracts, and so on. Or, you can own a fraction of the real estate through purchasing real estate investment trusts (REITs).

Let’s dive into a case study of Kimco Realty (KIM) and explore the 7 critical details of REITs. Let’s also explore how you can use them to profit from its price appreciate, earning passive income along the way!

#1 Defensive Stock

Do you remember what makes a defensive stock?

Stocks that belong in the consumer staples, utilities, and REIT sectors are defensive as the products and services they provide generally aren’t affected by the state of the economy. Since KIM is a REIT, it fulfills the criteria of being a defensive stock.

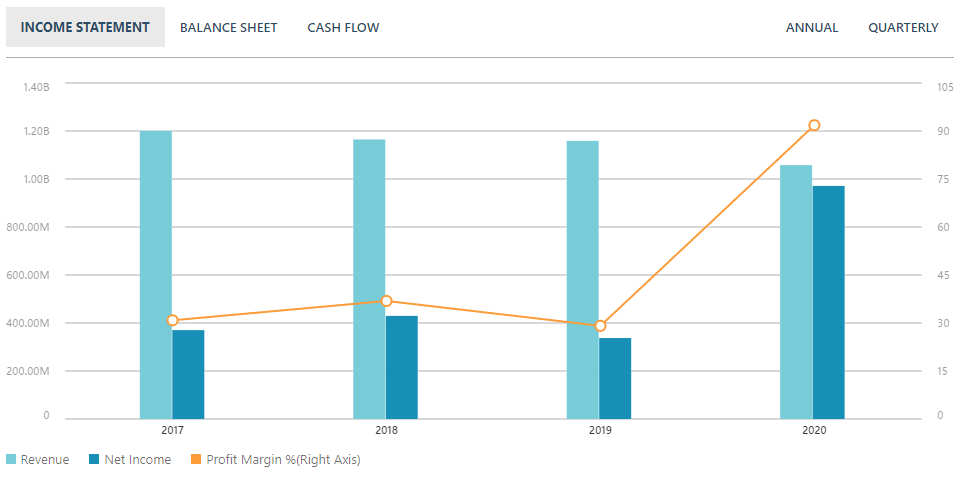

#2 Stable Profit Margin

KIM’s profit margin has been stable from 2017 to 2019, hovering between 30 and 40%.

In 2020, KIM’s profit margin soared to a mouth-watering 90+%! This is extremely encouraging given the crisis brought about by the coronavirus.

You don’t have to dig into KIM’s annual reports as you can find this chart from MSN Money.

#3 Stable Positive Free Cash Flow

Cash flow is the bloodline of every business. If it’s free cash flow is positive, the company is making money.

Here, we can tell that KIM is making more than $1 billion even in a difficult year (2020). This tells us that KIM is resilient in tough times.

You can also get this data from MSN Money.

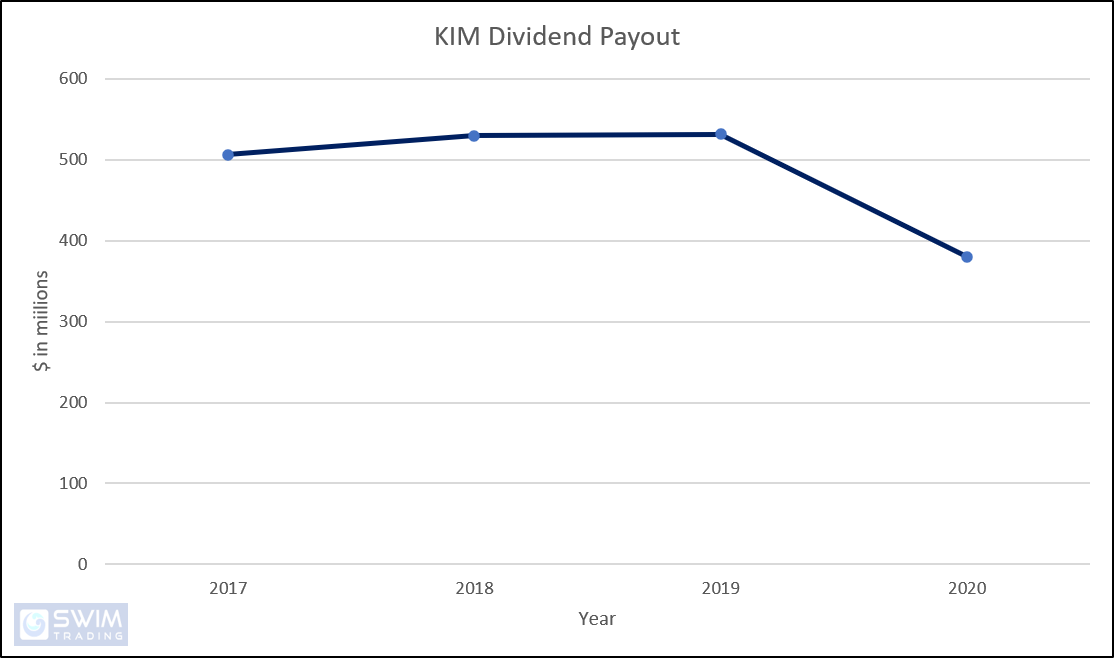

#4 Stable Dividend Payout

Has KIM’s dividend payout been stable? Let’s have a look at the chart below.

From the chart above, we can tell that KIM’s dividend payout has been pretty consistent. Hence, KIM fulfills the condition of having a stable dividend payout.

Oh yes, this data can also be found on MSN Money.

#5 Dividend Payout Ratio

When a company’s dividend payout ratio is at 100% or more, this means that the company is giving out more than it made. This isn’t sustainable as the company could bleed a slow death and investors would lose their money in the near future unless there’s a turnaround.

KIM’s dividend payout ratio is 0.71 (or 71%). This is reasonable as it is a REIT. REITs are required to give out most of its earnings as dividends to enjoy special tax treatment. That’s another topic for another day.

#6 Interest Expense Ratio

The interest expense ratio is another measurement of the health of a company. A ratio of less than 40% is ideal as this tells us that the interest expense is manageable.

KIM’s interest expense ratio is below 40% and this is good. Its interest obligation isn’t suffocative.

#7 Timing Your Investment

Once the stock you’re interested in passes the 6 criteria above, it’s time to uncover sweet investing opportunities. Timing can make a big difference, deciding if you start making money sooner or take a long time to breakeven.

How can you time your investment?

You can time your investment using technical analysis.

Technical analysis is the study of price charts. Investors who practice technical analysis believe that all information of any stock has been baked into its price. Therefore, they watch the movement of prices which is termed as price action.

Such investors use a couple of indicators, chart patterns, and tools to help them in their assessment.

Do you have what it takes to be a successful investor using technical analysis? Find out here.

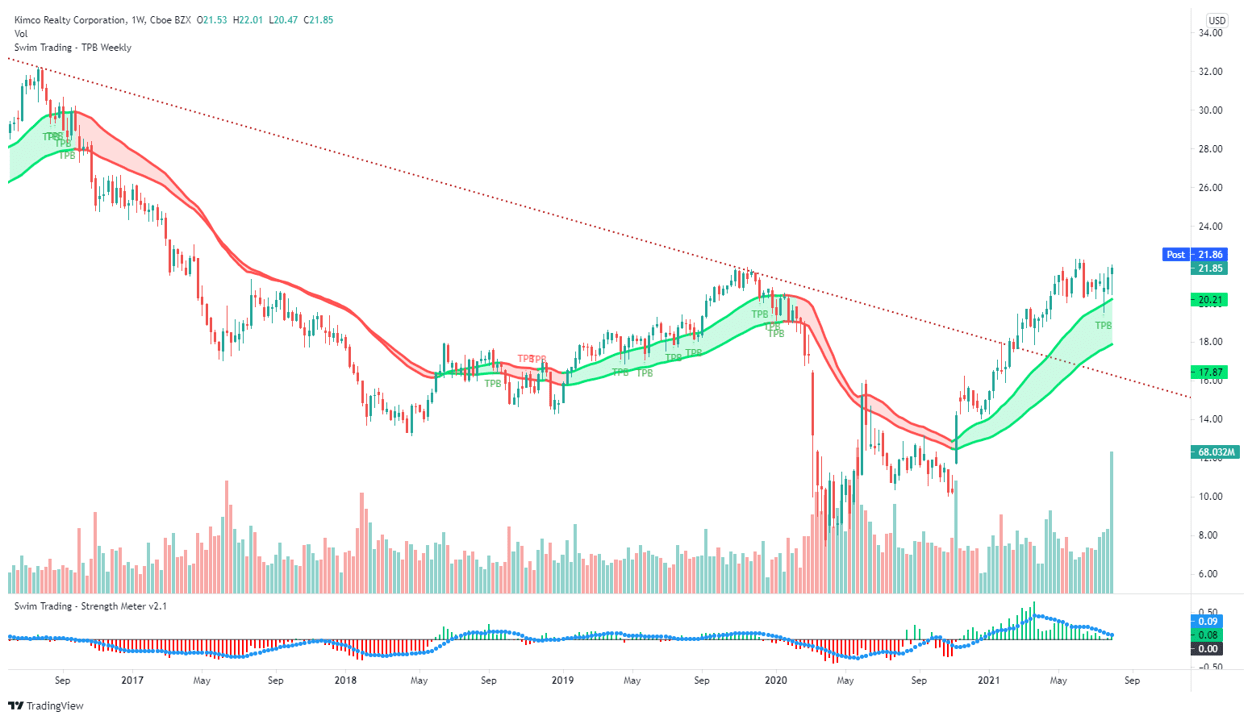

Let’s analyze the weekly chart of KIM.

KIM was in a long-term downtrend from late 2016 to early 2021. Investing in KIM before 2021 was likely to leave you with massive losses (financially, emotionally, mentally, time, and the inability to seize onto other better opportunities).

It was only in late Feb of 2021 that the downtrend was broken, turning the downtrend into an uptrend.

Optimal entry points can be easily spotted using the weekly TPB strategy. Here’s how.

Green TPB signals indicate that it’s a good time to buy and invest while red TPB signals indicate that it’s a good time to go short or sell.

Since following the trend will help you make money through the difference in price (on top of receiving dividends), it’s highly advisable to follow the green/red TPB signals in an uptrend/downtrend respectively.

We’ve established that KIM is in an uptrend. We can also see that the green TPB signal is up. Should you invest in KIM now?

The optimal time to buy KIM was 2 weeks ago. What should you do then?

Wait.

You should be patient and wait for the next green TPB signal to come on.

I’ll be adding this stock to my watchlist.

4 Things You Must Remember

So there you have it! KIM is a fantastic REIT which is worth investing in based on the above 7 criteria.

Did you catch these 4 main points?

#1 Real estate investment trusts are defensive in nature

#2 KIM’s business model is stable and healthy

#3 Technical analysis can help you time your investment

#4 Utilizing the TPB strategy can help you spot opportunities easily

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Go secure and build your wealth!