Here’s the second part of the glossary. You will find the definitions of the trading terms which start with A-C here.

D

Day trading: The opening and closing of a trade within the same day before the market closes.

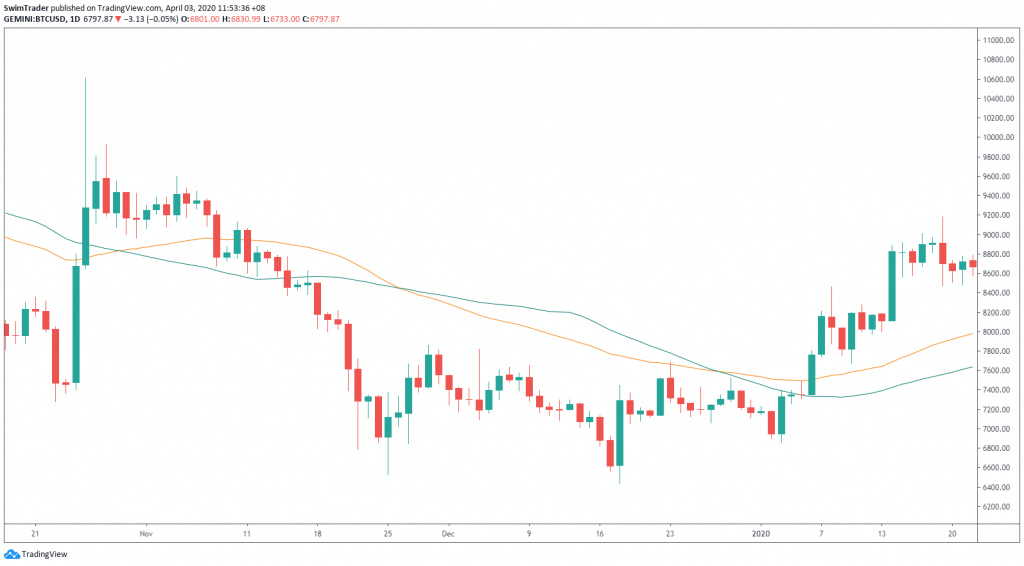

Death cross: A bearish signal where the 50 day simple moving average (SMA) crosses below the 200 day SMA.

Eg. A death cross formed on the chart of Bitcoin in late Oct 2019 (see the circled area).

The 50 day SMA is depicted in green while the 200 day SMA is shown in purple.

Derivative: An instrument whose value is based on its underlying asset (stock, commodity, futures etc).

Distribution: Sell more

Divergence: The price and oscillator directions do not agree to each other.

Dividend: A payout from the company to its shareholders.

Dollar cost averaging: A strategy where the investor invests a fixed amount of money at a regular interval regardless of the market trend and structure.

Eg. You invest $500 into Starbucks every month. The number of units you are able to purchase when the market is trending up is fewer than when the market is trending down.

The arrows indicate the first trading day of each month. The share price on that day will determine the number of shares you will buy under the dollar cost averaging strategy.

E

Earnings: Profit generated by a company.

Earnings per share (EPS): Profit generated by a company divided by the number of common shares the company has listed in the stock market.

Equity: Ownership of a stock market investment.

Exchange traded fund (ETF): A type of investment fund which has a basket of bonds, commodities, stocks or others.

Eg. SPY is the ETF of SPX (S&P500).

Execution: The completion of a buy or sale of a security.

Exhaustion: A decrease in momentum.

Expectancy: The expected probability of a profit or loss for a trading strategy.

Expert advisor: A program which notifies when to initiate and execute trades. It may even automatically trade for you.

Exponential moving average (EMA): A moving average indicator which gives more weight to the latest session.

The 50 day EMA is shown in orange while the 50 day SMA is shown in green. Do you notice that the EMA is more responsive to price changes?

Are there other types of moving averages? How can you use the moving average indicator to help you? Find out in Part 1 and Part 2.

F

Federal Reserve: America’s central bank.

Fed speak: A speech by any committee member of the Federal Reserve.

Filled: The completion of the trade order.

Float: The number of shares of a company which are made available to the public.

Foreign exchange (forex): Currency of another country.

Fundamental analysis (FA): A method of evaluating a company’s businesses and macroeconomics.

Discover which FA metrics to use and how you can use them to swing trade US stocks here.

Pat yourself on the back for taking action to learn and grow!

Stay tuned as I will be back for the next part of the glossary.

Here’s What You Can Do To Improve Your Trading Right Now

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

See you around!