“What is Bitcoin?”

I was asked this question some months back and I was caught offhand. This may seem as a simple question to answer, but it’s actually quite complex, so much so that many Bitcoin investors don’t seem to really know what they’re investing in.

A simple answer would be Bitcoin is a cryptocurrency which is digital cash. Some perceive it as digital gold.

But this simple answer won’t suffice. Not for serious retail investors.

So, what exactly is Bitcoin without boring you?

#1 What Is Bitcoin?

For clarity, I shall use BTC to stand for the cryptocurrency of Bitcoin’s blockchain.

You already know that BTC is a form of digital cash. You can send it to friends and make payments with BTC. Yes, there’re merchants accepting payment in BTC.

BTC is also nicknamed “digital gold” due to its limited quantity, scarcity, and the level of difficulty to be produced. Let’s explore each of these traits.

a) Limited Quantity

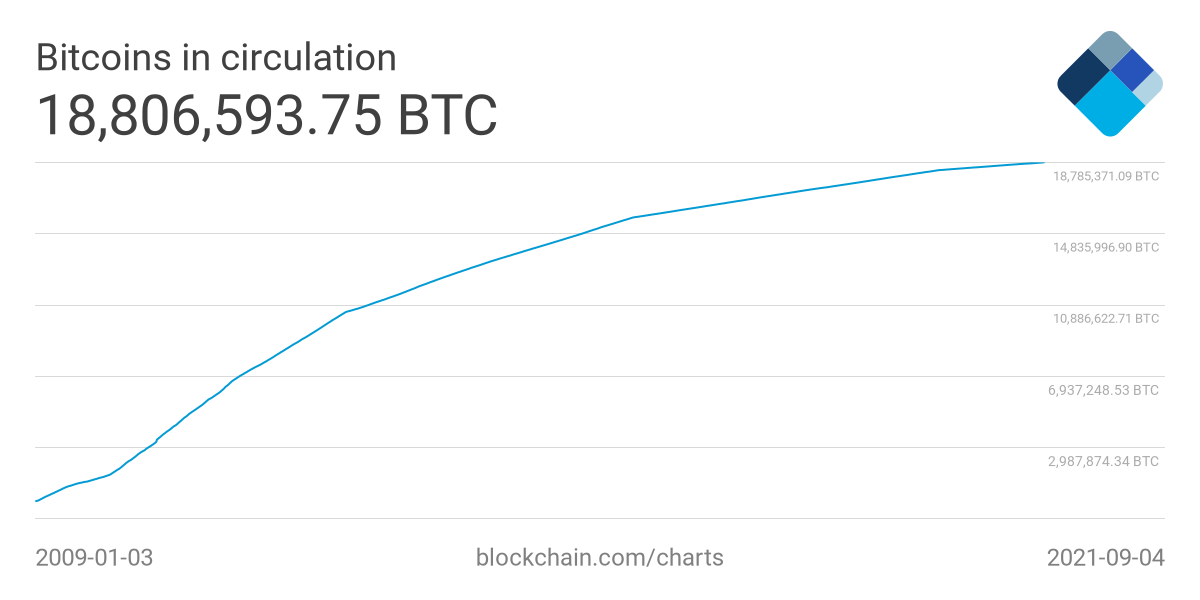

The Bitcoin blockchain is coded to have a max supply of 21 million BTC. 18.8 million BTC have been mined, leaving us with 2.2 million BTC more to go. Will this piece of code change, I highly doubt so.

b) Scarcity

Demand for BTC is high in some countries as a medium of exchange/payment. El Salvador has made BTC legal tender and this will take effect on 7 Sep 2021. El Salvador has even given her citizens $30 worth of BTC to every adult citizen.

Hedge funds and investment banks have also started Bitcoin funds for their ultra-wealthy clients.

c) Difficult To Produce

BTC is mined. It’s a highly difficult process which will be explained in the section “How Does The Bitcoin Blockchain Work? Is It Secure”

There’re a couple more reasons why BTC is loved. The Bitcoin blockchain is decentralized, censorship-resistant, secure, and borderless. This makes BTC share the same characteristics as its blockchain.

A comparison of fiat money and cryptocurrency has been done and you can read about it here.

#2 History Of Bitcoin

Bitcoin is founded by Satoshi Nakamoto and launched in 2009. No one knows who Satoshi Nakamoto really is.

Do you remember what happened between 2007 and 2009? Yes, the global financial crisis took place back then. Big financial institutions went bust and some got lots of financial aid to stay afloat.

To save these large firms, the Federal Reserve printed billions of dollars. The level of trust in financial institutions collapsed.

It was in this context which Satoshi Nakamoto envisioned BTC to be a decentralized digital currency and created the Bitcoin blockchain.

#3 How Does The Bitcoin Blockchain Work? Is It Secure?

As with most cryptocurrency, there’s a blockchain powering it. BTC is the cryptocurrency of the Bitcoin blockchain.

This blockchain is an open ledger, where every transaction is broadcasted and can be seen by the public.

Data security is of paramount importance. Only new data can be added to its blockchain and edits are not allowed, protecting its data integrity. This reduces the risk of double-spending. But how is data in the blockchain protected? Hashing.

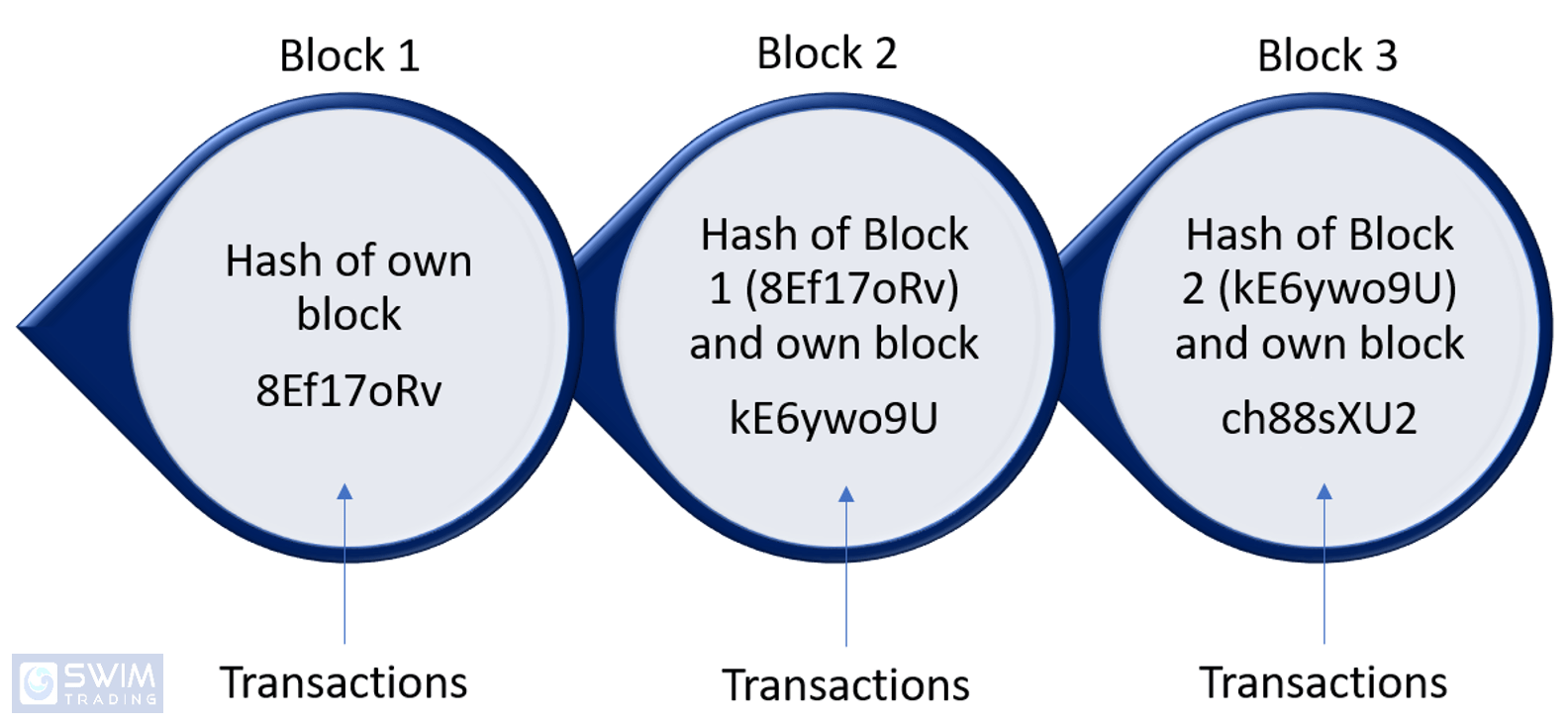

Every block in the Bitcoin blockchain has its own hash and the hash of the previous block for validation. A hash which is a unique identity number of each block in the blockchain. Any tampering with old data leads to a change in its block’s hash. The blockchain will not recognize the edit as the hash of the edited block won’t match the hash that’s given to the next block.

Here’s a simplified diagram.

Ok, so what’s the proof-of-work consensus that Bitcoin uses? This means that work is needed by miners to create new blocks on the blockchain.

When transactions occur on the Bitcoin blockchain, there’s a need to verify and add the data to blocks, which are in turn added to the blockchain. To add blocks, miners need to solve a cryptographic puzzle. The first miner to solve it gets rewarded with fees and new mined BTC.

The difficulty of the cryptographic puzzle depends on traffic as a block can only be created approximately every 10 mins. This is why BTC transaction confirmation takes roughly 10 mins, leading many to laugh off BTC as being a medium of exchange. Imagine paying for your grocery in BTC. A snaking queue will probably form.

BTC goes through halving every 210,000 blocks. That’s around every 4 years. This means that the creation of BTC goes slashed by half once every 4 years. Since 11 May 2020, 6.25 BTC is created with every block mined. When the Bitcoin blockchain 1st started in 2009, 50 BTC was given to any successful miner.

The next halving will be sometime in 2024, where only 3.125 BTC will be mined each time. Mining rewards will stop around year 2140 where BTC has reached its max supply of 21 million.

#4 2 Safe Ways To Invest In Bitcoin

I can sense your excitement. You want to invest in this digital gold.

You’ve come across ads or emails asking you to buy BTC from them. Is that safe? How can you invest in BTC safely?

#1 Buy BTC From A Cryptocurrency Exchange

You can buy from reputable cryptocurrency exchanges such as Binance International, Huobi Global, Kraken, and a couple more. You can compare them in this article.

The method to purchase BTC differs slightly for each exchange, so please check out their tutorials beforehand.

#2 Buy Shares Of Companies In The Cryptocurrency Space

As blockchain technology becomes more widely adopted and accepted, there’s a growing number of listed companies in the blockchain and/or cryptocurrency scene. Therefore, you may even consider buying shares of these companies instead of owning BTC – Microstrategy (MSTR), Square (SQ), Grayscale Bitcoin Trust (GBTC), Coinbase Global (COIN), and more.

You’ll need to setup a brokerage account to trade stocks. You can find a comparison on 7 popular stock brokers in Singapore here.

#5 Storing Your Bitcoin In A Safe Place

The next question that comes to mind after buying your BTC is where you should be storing your BTC. You’ll want them to be stored in a safe place as they are expensive assets which could rise in value over time.

There are 2 main categories of wallets to store your BTC in – custodial and non-custodial.

A custodial wallet is one where you don’t own the keys to the wallet. By this, I mean that you don’t own the key to your BTC.

Placing your BTC in a custodial wallet is akin to passing money to the bank for safekeeping. Banks do get robbed, hacked, catch fire, and more.

Custodial wallets are usually hot wallets which are provided by the various cryptocurrency exchanges. Binance International and its local exchanges, Kraken, Huobi Global, Gemini, Tokenize Xchange provide wallets for you to keep your BTC.

On the other hand, non-custodial wallets are those that you own. You’ll hold onto the keys of a non-custodial wallet. Such a wallet can come in the form of hot and cold wallets. Let’s begin with the hot wallet.

Non-custodial hot wallets include mobile and software wallets. An example of a non-custodial mobile wallet is Trust Wallet. Metamask is an example of a non-custodial software wallet.

Non-custodial cold wallets include paper and hardware wallets. Hardware wallets include Ledger and Trezor.

Here are 2 security tips:

a) Set up your wallet in a safe place without CCTV and don’t tap onto public WiFi networks.

b) Write the mnemonic/seed phrase of your wallets on a piece of paper and never disclose it to anyone. You may even want to make copies as the you’ll need the seed phrase as a proof of ownership over your BTC.

6 Things You Must Remember

#1 BTC is limited in quantity, scarce, and difficult to produce

#2 Bitcoin was invented by Satoshi Nakamoto during the global financial crisis

#3 How the Bitcoin blockchain works and how it is secured

#4 You can invest in BTC safely in 2 ways

#5 There are different types of wallets to help you store your BTC safely

#6 Due to the volatility of BTC, it’s wise to also invest in other instruments such as stocks

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

Invest safely!