The US stock market posted a huge gain yesterday! Have you seen this kind of headlines and wondered what journalists were referring to? They were highly likely to be referring to the S&P 500 or Dow Jones Industrial Average Index.

Individual stocks are rarely talked about in the press unless there’s big news such as an explosive rally in its stock price or an imminent bankruptcy.

Being aware of the major stock market indices are important to your trading career because you will need to know where the general stock market is heading. You do not want to buy any stock blindly, without checking on the overall direction of the stock market.

What is a market index?

A market index is made up of a portfolio of stocks. These stocks are known as components. Components can come in the form of bonds or a group of other market indices too. The MSCI Emerging Markets Index contain 26 market indices, including that of Brazil, China, Russia, Turkey and more.

There are a handful of market indices in the US, of which the more important ones are the Dow Jones Industrial Average, Nasdaq composite, and S&P 500.

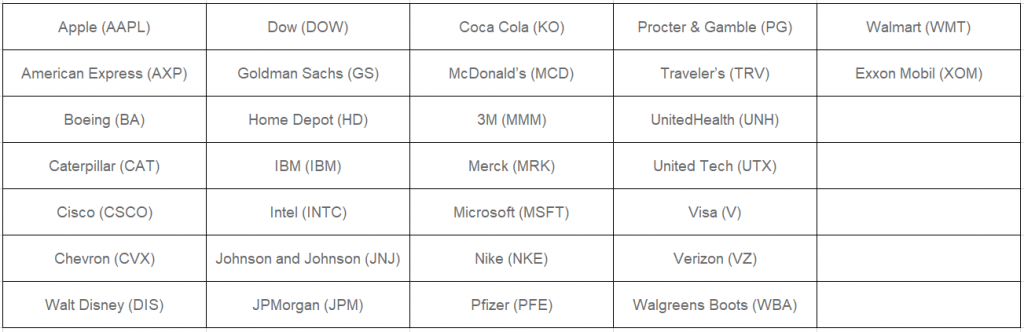

The Dow Jones Industrial Average, commonly known as the Dow 30, is made up of 30 companies. These companies are:

These companies are the major players in their respective industry, best reflecting the US economy.

How the indices are calculated

Dow 30 is a price-weighted index. This means the higher the price of the stock, the higher weightage in the index. This can sometimes be misleading because a $1 change in a $10 stock (10% change in price) should be considered to be more significant than a $1 change in a $100 stock (only a 1% change).

However, Dow 30 is still monitored by traders to see how the large companies in the US are performing as a group.

Another type of calculation is capitalization-weighted. This means that the larger companies in terms of market capitalization carries more weight. To calculate a company’s market capitalization, multiply the number of available shares by its market price.

The S&P 500 is one such index.

Is it necessary to know the details of the index calculation?

No. As a trader/investor, it is enough to know that there are two kinds of calculations – price-weighted or capitalization-weighted.

What are market indices for?

Now that you know what indices are, you can start monitoring them to see how the broad markets are performing. You do not want to buy any stock being blindsided because you failed to check on the overall direction of the stock market.

If you trade US stocks, you can check out Dow 30, Nasdaq, and S&P 500.

If you trade bonds, you can monitor the bond indices.

If you trade Singapore stocks, you can check out the Straits Times Index (STI).

If you are interested in the stock market of a certain country, check out index exchange traded funds (index ETFs). Index ETFs allow you to go long or short sell according to your judgment.

Knowing what an index is is important for any trader to get a hold of the larger picture.

Here’s What You Can Do To Improve Your Trading Right Now:

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

See you around!