Close to 1.3% of the world’s population is using cryptocurrencies. Is there a future for cryptocurrencies?

The number of cryptocurrencies users stands at approximately 101 million. There were 35 million cryptocurrencies users in 2018. This is a near 190% increase!

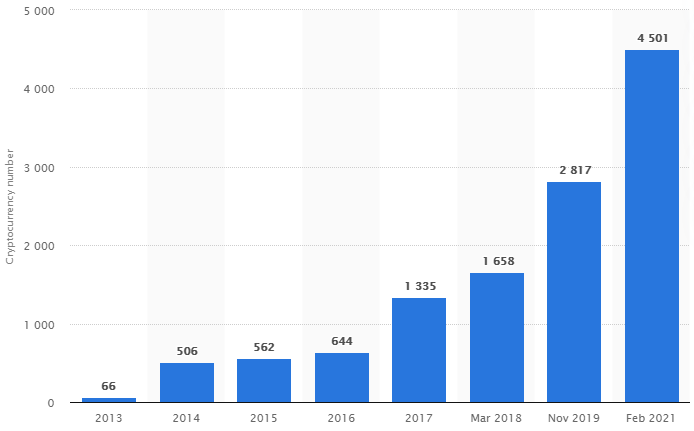

Of all the 4000+ cryptocurrencies that are available, Bitcoin is the undisputed king. It is also referred to as digital gold. Why?

Bitcoin has the largest market capitalization, the hardest cryptocurrency to mine, and is the most talked about cryptocurrency.

But what exactly is a cryptocurrency? Before explaining what cryptocurrencies are, you’ll need to understand the current monetary system we are using – fiat money.

#1 What Is Fiat Money?

Fiat money is the money that we use today. Currencies that are issued without the backing of any commodity are known as fiat money.

Fiat money can come in the form of banknotes, coins, savings, digital numbers, and more. Examples of fiat money includes USD, Euros, Japanese Yen, Chinese Yuan, Malaysian Ringgit, Thai Baht, Singapore Dollar etc.

It’s main role is to facilitate trade and transactions.

There is a central authority which oversees and/or determine the supply and legality of fiat money in every country. In the USA, it is the Federal Reserve. In Singapore (where I’m from), it is the Monetary Authority of Singapore).

Did you know that fiat money was used as early as in the 11th century in China?

Since fiat money is issued by the government without the backing of any commodity, there is no intrinsic value to it. Therefore, the perceived value of fiat money is highly dependent on the trust of the issuing government.

The issuing government has the ability to manipulate its currency through keeping its currency rate low for political and economic reasons.

Interested in learning how you can trade currencies? Click here to get started.

Global Financial Crisis Of 2007

Let’s start off with a short history of the last global financial crisis. This will provide the context to the invention and demand of cryptocurrencies.

The world was caught in a financial mess in 2007.

Banks and mortgage companies were lending money to almost anyone, including those who would’ve been deemed unqualified. A housing and financial bubble was created.

The housing bubble in the West burst in 2007. Banks and other financial institutions were owed huge sums of money which their borrowers didn’t have the ability to repay.

This led to the bankruptcy of many financial institutions in USA and worldwide. Through globalization, far away countries also felt the ripple effect.

The West started to print more money to save as many giant companies as they could. Many giant companies around the world got bailed out.

People started losing faith in financial institutions and their governments. There was political and economic unrest.

The perceived value of fiat money was lacking. Ordinary people and investors started to buy gold and other safe haven instruments. The price of gold shot up by a whooping 42% in a year (mid 2007 to mid 2008).

Enter Bitcoin.

#2 What Are Cryptocurrencies?

Understanding that governments have total control on the issuance and legality of fiat money, you are ready to explore cryptocurrencies.

History Of Bitcoin

Apart from being the king of cryptocurrencies, Bitcoin is also the oldest cryptocurrency. It is invented in 2008 by Satoshi Nakamoto.

The identify of Satoshi Nakamoto is unknown. No one knows for sure if Satoshi Nakamoto is the actual name of a person or group.

Bitcoin came to use in 2009, at the height of the Global Financial Crisis.

Bitcoin is decentralized, unlike fiat money. This means that there is no central authority involved. Banks are not needed for transactions of cryptocurrencies.

The Nature Of Cryptocurrencies

Cryptocurrencies are a necessary by-product of blockchain technology.

Blockchain is a new technology which enables data and/or transactions to be stored in many nodes, in a decentralized manner.

Data and transactions stored in blockchains are highly secure because they are verified and cannot be changed.

Remember getting a bonus because you helped to clinch a big business deal for your employer? Cryptocurrency is awarded to those who help to keep the data and transactions in blockchains secure and accurate.

Some cryptocurrencies have a capped market supply. Some others have a fixed yearly supply. Both types keep inflation at bay.

The Explosion of Cryptocurrencies

The number of cryptocurrencies have increased exponentially as shown in the graph above.

This suggests that the major cryptocurrencies are here to stay and become part of our daily lives.

Does this mean that you need to pay attention to all 4500 of them? Just like stocks, the answer is No.

Decide if you’d like to focus on the major cryptocurrencies or newly minted cryptocurrencies.

#3 Comparison Of Cryptocurrencies And Fiat Money

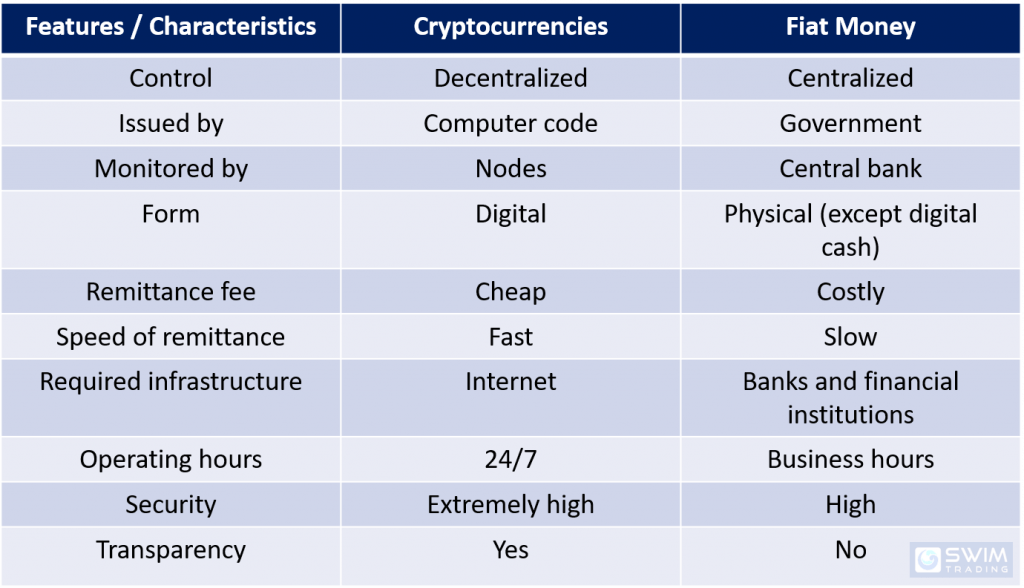

After learning about fiat money and cryptocurrencies, here’s a table of comparison.

Here’s an elaboration of the features and characteristics:

a) Control

No one person or entity can control any cryptocurrency.

This is unlike fiat money where the government has full authority over it.

b) Issued by

Cryptocurrency is made up of “cryptography” and “currency”. This means that cryptography, or computer codes, are utilized in encrypting, decrypting, and issuing cryptocurrencies.

On the other hand, fiat money is issued by the government.

c) Monitored by

There are nodes in every blockchain which help to verify and secure the blockchain network. They monitor for false entries.

Fiat money is monitored by central banks. They monitor the quantity, printing material, business activity and all other factors which affect the fiat money.

d) Form

Cryptocurrencies are purely digital. There is no physical coin which you can hold, touch, or keep in your pocket.

Fiat money is tangible.

e) Remittance fee

Transaction fees (especially remittance) are usually low. Fees climb when there is a spike in demand.

Try wiring your money abroad and you’ll be charged a high fee, as much as USD45!

f) Speed of remittance

If you have remitted money, you’d know that it takes about a day or as long as a week for the receiver to receive the amount.

For cryptocurrencies, it takes minutes to a couple of hours.

g) Required infrastructure

All you need is to be connected to the Internet to transact cryptocurrencies.

Fiat money requires a banking infrastructure and ATMs for you to access to banknotes. Imagine living in a remote village where the nearest ATM is more than 5km away.

h) Operating hours

Because all you need is to be connected to the Internet to transact cryptocurrencies, you can transact at any time you like.

This is unlike fiat money as certain financial transactions require you to be at the branch of a financial institution during its operating hours.

i) Security

Using cryptography, and the fact that data stored in any blockchain network cannot be changed, the security and accuracy of data is extremely high.

Systems that banks use are robust. However they can still be hacked.

There’s also the possibility of entering false or incorrect data which can go undetected, affecting the integrity of the data.

j) Transparency

Transactions of public blockchains are open and thus can be viewed by anyone. More about blockchains will be discussed in the next article.

The amount of cryptocurrency given out as a reward to those who help keep the network secure is also made known to the public.

There’s close to no transparency regarding fiat money. No government will give you an exact amount of cash reserves its has.

Advantages And Disadvantages Of Cryptocurrencies

Are cryptocurrencies all that good? Let’s find out.

Here’s an outline of the advantages and disadvantages of cryptocurrencies.

Advantages

The 1st 3 advantages of cryptocurrencies – low transaction fees, the speed and ease for transactions have been explained in the previous segment.

I shall elaborate on the other advantages.

a) Secure and immutable

Due to the fact that all data has to be verified and there’s an incentive for nodes and miners to do so, all data is highly secured and immutable. Nothing can be changed.

b) Little to no inflation

Many cryptocurrencies have a fixed limit to its supply. Some have a fixed issuance per year to keep inflation low.

c) Private

The cryptocurrencies you own are yours and no one will have access to them. This is because no one will have access to your private keys (More about private keys in my upcoming article).

d) Reduces corruption

Cryptocurrency is fully digital and every transaction is recorded, unless you transact using privacy coins (I’ll talk about privacy coins in another article).

e) Serves the unbanked

The unbanked usually live in rural or remote areas where banking is a challenge.

Without the need of a bank or any financial intermediary, cryptocurrency solves this gap, enabling everyone to receive and send funds as long as they are connected to the Internet.

f) No double spending

Double spending is impossible except when a blockchain has been hacked.

g) High returns

Cryptocurrencies are still in its infant stage where returns are astronomically high in percentage terms.

However, there are disadvantages too.

Disadvantages

a) Easy to manipulate by whales

Most cryptocurrencies have a small market capitalization. A low market capitalization exposes the cryptocurrency to manipulate risks through schemes such as pump and dump.

b) Lack of regulations

This is an issue for cryptocurrencies as our laws have not caught up with technology.

Until regulations for cryptocurrencies are up and in place, widespread use of cryptocurrencies will take some time.

c) Ban on cryptocurrencies

There are a number of countries which have banned its citizens and residents from owning and using cryptocurrencies. China is a prominent country to have outlawed cryptocurrencies.

This makes ownership of cryptocurrencies uncertain and risky.

d) Not environmentally friendly

Lots of computing power is needed to verify data and mine cryptocurrencies. This translates into high energy consumption which is bad for the world.

e) Can be used for illegal transactions

The use of privacy cryptocurrencies (aka privacy coins) shield the identity of senders and recipients. This opaqueness encourages illicit transactions.

f) Open to hacks

Like all other technology, blockchains are open to bugs and hacks. There is always a chance of your cryptocurrencies being hacked, however small the chance is.

g) Open to human error

Blockchains are developed by computer programmers. Human error in writing codes can result in vulnerabilities, which may ultimately cause your cryptocurrency to be stolen or lost.

h) High volatility

This is linked to the fact that the cryptocurrency market is still new and small.

Anyone with USD1m can move the price of most cryptocurrencies.

i) Can be lost forever

Owning cryptocurrencies require you to remember your password and/or private keys.

There is a fixed number of tries, should you forget your password or private key details. Once you have exceeded that limit, your cryptocurrencies are lost forever.

#4 Are Cryptocurrencies The Future Of Money?

You’ve heard of huge companies such as Tesla and Square purchase millions of dollars worth of cryptocurrencies.

You’ve also heard and well-known investors such as Mark Cuban and Paul Tudor Jones buy large amounts of cryptocurrencies.

It is therefore logical to ask if fiat money will be replaced by cryptocurrencies.

Cryptocurrencies can be the future of money depending on several factors – clear regulations to protect users of cryptocurrencies, the willingness of governments to think of other solutions to our economic problems instead of increasing money supply, improved legal, banking, and transportation infrastructure in rural and remote areas, reduced corruption among officials, and more.

With clear and wise regulations, the volatility of cryptocurrency prices will decrease, encouraging more to adopt cryptocurrencies as a mode of payment.

It is likely that fiat money will still be heavily relied on in the near future unless there are dramatic changes. Who knows?

5 Lessons You’ve Learnt Today

#1 The meaning and origins of fiat money

#2 The history of Bitcoin and cryptocurrencies

#3 The nature of cryptocurrencies

#4 The similarities and differences between cryptocurrencies and fiat money

#5 The advantages and disadvantages of cryptocurrencies

Here’s What You Can Do To Improve Your Trading Right Now

#1 Register for our market outlook webinars by clicking here

#2 Join us in our Facebook Group as we can discuss the various ways of applying this by clicking here

#3 Never miss another market update; get it delivered to you via Telegram by clicking here

#4 Grab a front row seat and discover how you can expand your trading arsenal in our FREE courses (for a limited time only) by clicking here

See you around!